1. Introduction

1.1 These Terms of Appointment and further guidance (the Terms) are issued in accordance with the audit contracts between firms and PSAA. They are effective for all audit appointments made under the Local Audit and Accountability Act 2014 and the Local Audit (Appointing Person) Regulations 2015 (the Regulations). They are issued for the purpose of clarifying the standards for performing the Services under the contracts, and to provide a single point of reference for matters of practice and procedure which are of a recurring nature.

1.2 Auditors must comply with the requirements set out in the Code of Audit Practice (The Code) issued by the Comptroller and Auditor General in statute, and in the contracts each firm has with PSAA. These requirements are not duplicated in the Terms.

1.3 The Terms set out service performance standards that auditors must comply with, over and above those set out in legislation, the Code of Audit Practice, guidance to auditors provided by the NAO and by professional regulators (FRC and ICAEW as Recognised Supervisory Bodies (RSBs)). Nothing in the Terms can override those requirements. They are updated as changes are required following consultation with the firms. Key parts are highlighted in bold but firms are required to comply with the Terms in full.

1.4 The Terms form part of the appropriate systems that PSAA, as the specified appointing person, must design and implement under the Regulations to:

- oversee issues of independence of any auditor which it has appointed, arising both at the time of the appointment and when undertaking work;

- monitor compliance by a local auditor against the contractual obligations in the audit contract; and

- resolve disputes or complaints from local auditors, opted-in authorities and local government electors relating to the audit contracts and the carrying out of audit work by auditors it has appointed.

1.5 Throughout the Terms, the word ‘Auditor’ covers the firm and Key Audit Partners nominated by a firm to discharge its statutory obligations.

1.6 Auditors must ensure they are familiar with the PSAA Statement of Responsibilities of Auditors and of Audited Bodies as this statement explains where the different responsibilities of auditors and of the audited body begin and end and what is to be expected of the audited body in certain areas.

1.7 The NAO issues guidance to auditors. Auditors must have regard to this guidance where applicable. Contact Partners must also have regard to any additional requirements specified in Contact Partner Letters (CPL) which may be issued by PSAA from time to time.

1.8 PSAA publishes the scale of fees for opted-in bodies, based on the work auditors are required to undertake each year.

1.9 The Terms apply to all work undertaken relating to the contracts (referred to as ‘local audits’ throughout these Terms). In the event of any conflict, the relevant legislation, the Code and the audit contracts, where applicable, prevail.

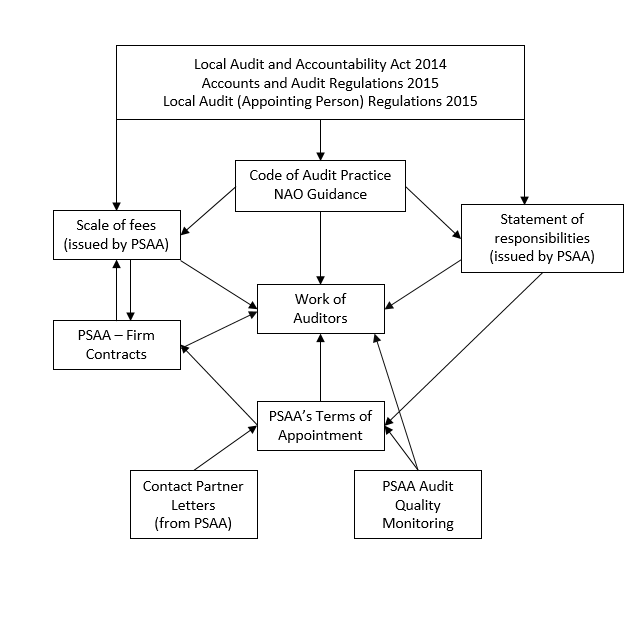

1.10 The diagram below shows how the Terms interact with legislation, the Code, the audit contracts (and other documents) and other guidance produced by the NAO.