Strategic Report

The directors present their strategic report for the year ended 31 March 2018.

1. Objectives and operating environment

PSAA’s responsibilities and aims are expressed through a series of objectives, covering:

- appointing auditors to relevant authorities;

- setting a scale or scales of fees, and charging fees, for the audit of accounts of relevant authorities and consulting with relevant parties in relation to those scales of fees;

- ensuring that public money from audit fees continues to be properly accounted for and protected;

- overseeing the delivery of consistent, high quality and effective audit services to relevant authorities;

- ensuring effective management of contracts with audit firms for audit services to relevant authorities;

- being financially responsible having regard to the efficiency of operating costs and transparently safeguarding fees charged to audited bodies; and

- leading its people as a good employer.

A memorandum of understanding with the Ministry of Housing, Communities and Local Government sets out the broad framework in which PSAA operates[1]. The memorandum reflects the content of PSAA’s articles of association and other founding documents and contains the agreed principles regarding PSAA’s operation and the mechanisms for its accountability for, and safeguarding of, public money in the form of audit fees charged to audited bodies.

During 2017/18 the company was responsible for a set of statutory functions delegated to it on a transitional basis from the Audit Commission Act 1998. These functions required PSAA to manage audit and assurance contracts novated to it in relation to audits of local government and NHS bodies. This work ends in phases, with the last audits of principal NHS bodies and final assurance assignments in relation to small bodies[2] completed in 2017. Audits of principal local government bodies[3] under the transitional arrangements will continue into early 2019. In fact much of the work in relation to local government bodies will continue beyond 2019, under new audit contracts linked to PSAA’s new appointing person responsibilities.

[1] Signatories to the memorandum of understanding also include the Department of Health, the Local Government Association, and the Improvement and Development Agency.

[2] Small bodies include parish councils and internal drainage boards with annual turnover below £6.5 million.

[3] Principal local government bodies include councils, fire and rescue authorities, local police bodies and other local government bodies.

In terms of the company’s new role, our functions relating to auditor appointments and the associated responsibilities derive from provisions of the Local Audit and Accountability Act 2014 and the Local Audit (Appointing Person) Regulations 2015 made under that Act. These functions require the company to ensure provision of good quality audits at a cost which represents good value for money to relevant authorities. The company has been preparing for these responsibilities since its specification in 2016 as the appointing person for principal local government and police bodies. These new responsibilities became operational with effect from 1 April 2018.

2. Business review

In our third full year of business, covered by this report, the company’s focus has been on developing and implementing the arrangements necessary to discharge our statutory auditor appointment and associated responsibilities as an appointing person from 1 April 2018. We have also continued to deliver the functions delegated to PSAA under the transitional arrangements, which end in early 2019.

Audit services procurement

During 2017/18 PSAA undertook a major audit services procurement exercise, for the audits of opted-in bodies for the appointing period 2018/19 to 2022/23. Work on the procurement started in February 2017 and concluded in July with the award of contracts. The procurement was designed to test thoroughly the audit quality to be provided by prospective bidders, as well as attracting highly competitive prices. The tender process also encouraged bidders to think creatively about maximising the social value benefits that could be delivered from the contracts. Their responses promise the creation of more than 400 new apprenticeships over the life of the contracts, many to be filled from more disadvantaged communities.

Contracts were awarded on the basis of the most economically advantageous tender, with 50 per cent of the available score awarded to price and 50 per cent to quality. The successful firms possess a wealth of public sector audit experience, inspiring confidence that high standards of service will be maintained. An element of our procurement strategy was to maintain breadth in the number of firms with PSAA contracts. We were able to award six contracts, to five firms plus a consortium of two firms, from the ten firms eligible (that is, approved by the relevant recognised supervisory bodies) when the procurement was undertaken.

The results of the procurement, announced on 20 June 2017, meant PSAA was able to award the following contracts:

| Lot | Value per audit year | Firm |

| 1 | £14.6 million | Grant Thornton LLP |

| 2 | £10.9 million | Ernst and Young LLP |

| 3 | £6.6 million | Mazars LLP |

| 4 | £2.2 million | BDO LLP |

| 5 | £2.2 million | Deloitte LLP |

| 6 | no guaranteed value of work | consortium of Moore Stephens LLP and Scott-Moncrieff LLP |

Auditor appointments

Following completion of the audit services procurement, PSAA prepared proposals for the allocation of auditor appointments to each firm, taking account of any potential independence considerations for individual firms and the joint working arrangements of opted-in bodies. We consulted opted-in bodies on our proposals and confirmed final appointments to each of the 484 bodies that had opted into PSAA’s national scheme before the statutory deadline of 31 December 2017.

Within the overall context of developing auditor appointments that represent value for money for opted-in bodies, we had regard to six principles approved by the PSAA Board:

- ensuring auditor independence;

- meeting our contractual commitments;

- accommodating joint/shared working arrangements where possible;

- ensuring a blend of authority types for each audit firm;

- taking account of a firm’s principal locations; and

- providing continuity of audit firm, if possible.

The primary consideration in allocating proposed appointments to individual opted-in bodies was to ensure independence, and then to balance the remaining principles. PSAA’s stakeholder advisory panel confirmed its support for this approach.

The PSAA Board approved all proposed appointments from 2018/19, following consultation with audited bodies, at its meeting in December 2017. We wrote to each opted-in body on 18 December 2017 to confirm the auditor appointment.

Setting audit fees

PSAA’s statutory appointing person responsibilities include specifying a scale or scales of fees for the audit of accounts of opted-in bodies. Before setting a scale of fees, we are required to consult opted-in bodies, appropriate representative associations of principal authorities, and appropriate bodies of accountants.

We consulted on a proposal to reduce scale fees for 2018/19 by 23 per cent, and to maintain fee stability if possible during the appointing period. Responses to the consultation welcomed the proposal. PSAA set the 2018/19 fee scale such that individual scale fees for all opted-in bodies are the fees applicable for 2017/18 with a reduction of 23 per cent. This gives opted-in bodies the benefit of the cost savings achieved in the audit procurement, and continues the practice of averaging firms’ costs so that all bodies benefit from the same proportionate savings, irrespective of the firm appointed to audit a particular opted-in body. The fee reduction also reflects and passes on the benefit of economies which PSAA is making in its own operating costs.

PSAA hopes to be able to maintain the 2018/19 reduction of 23 per cent in scale fees for at least the first three years of the appointing period, based on current assumptions about inflation and the amount of work auditors are required to undertake. However, the uncertainties are such that we cannot guarantee this at this stage. The most significant variables which are likely to influence our decision-making are:

- Inflation: there is uncertainty about the expected level of inflation but a generally rising trend. Our contracts with audit firms include provision for inflation adjustments in the later years of the appointing period.

- Code of Audit Practice: the NAO is required to publish a new Code every five years. The next Code will be applicable from 2020/21, the third year of the appointing period. Any changes to the approach required from auditors, whether this increases or decreases the work required, must be reflected in scale fees.

- Changes in financial reporting requirements: current scale fees reflect the audit work needed based on current financial reporting requirements. Changes to those requirements may have an impact on scale fees.

During the appointing period we will consult on scale fees each year, reviewing all our key assumptions and estimates, before publishing the fee scale for the following year.

Audit quality

PSAA is committed to ensuring that contracted firms provide good quality audits for opted-in bodies. We have undertaken significant work during 2017/18 on the arrangements to be used for monitoring audit quality and contract compliance from 2018/19.

We have adopted the International Auditing and Assurance Standards Board’s Framework for Audit Quality (the IAASB Framework) as the model for the appointing person audit quality arrangements. Audit quality formed a core part of the evaluation of tenderers in the 2017 audit services procurement, with tenderers encouraged to have regard to the IAASB Framework in their responses. Ongoing contract management arrangements have the dual purpose of reporting results to opted-in bodies, and ensuring that the company meets our obligations under the Local Audit (Appointing Person) Regulations 2015 to monitor compliance of auditors against the requirements in the audit contracts.

Our approach is based on the expectation that a quality audit is likely to be achieved by an engagement team that:

- exhibits appropriate values, ethics and attitudes;

- is sufficiently knowledgeable, skilled and experienced and has sufficient time allocated to perform the audit work;

- applies a rigorous audit process and quality control procedures that comply with law, regulation and applicable standards;

- provides useful and timely reports; and

- interacts appropriately with relevant stakeholders.

While responsibility for providing a quality audit rests ultimately with an auditor, audit quality, efficiency and effectiveness are shared responsibilities. The IAASB Framework notes that all parts of the financial reporting supply chain (including audit firms, regulators and standard setters) have a role in contributing to and encouraging an audit environment that supports high quality audits.

Local Audit Quality Forum

PSAA’s commitment to continuous improvement in audit quality for opted-in bodies will feature strongly in our work going forward. The company is sponsoring the establishment of a Local Audit Quality Forum (LAQF) to support the role of audit committees of opted-in bodies in relation to audit quality. The LAQF’s inaugural meeting took place in April 2018.

We believe that the forum will be a meeting place in which all of the parties that have a role in the responsibility for audit quality can share experiences and good practice. In particular we want to give a special focus to the work of local bodies and their audit committees, to help them play their critical and demanding roles effectively. We hope that audit committee chairs and chief finance officers will be regular attendees and active participants in all LAQF events.

Board appointments

During 2017/18 the company secured the membership of its Board for the next three years. The Chair and the other three existing members were re-appointed for a second three-year term, and the company made a new appointment of a fifth member of the Board from a strong field of candidates. The new Board member, Cllr Keith House, brings valuable experience as an elected council member and leader.

Other developments

Alongside these significant developments during 2017/18, PSAA’s work also included other notable achievements:

NHS bodies and smaller local government bodies

Under the transitional arrangements, PSAA has been responsible for overseeing the novated contracts for audit services at local NHS bodies and assurance assignments at smaller local government bodies. This work concluded at the end of 2017 with the completion of the 2016/17 audits, enabling PSAA to return £2 million of surplus income to NHS bodies in November 2016.

NHS bodies are now responsible for appointing their own auditors under the provisions of the Local Audit and Accountability 2014 Act. Appointments to smaller local government bodies (those with annual income or expenditure under £6.5 million) will be made by a separate specified appointing person, Smaller Authorities Audit Appointments Limited, for accounting periods starting from April 2017, unless relevant bodies opt to appoint their own auditor.

Securing the future of the VFM profiles

On the closure of the Audit Commission in March 2015, responsibility for maintaining the VFM profiles tool developed by the Commission was transferred to PSAA while a longer-term solution for the tools was considered. During 2017/18 PSAA reached agreement with the Local Government Association to move the data and analysis in the profiles to the LG Inform suite of tools, and the transfer was completed in January 2018.

This means the profiles are now freely available to audited bodies and auditors as part of a wider suite of data and analysis, and will no longer rely on, or require PSAA to maintain, legacy systems previously developed by the Audit Commission.

Restructuring

Anticipating the changes in its responsibilities from 1 April 2018, the company began a restructuring exercise in 2017/18, as part of a wider review of its costs. This has enabled the company to align the number and skills of the staff it employs with its business needs.

The restructure was undertaken in the context of the company’s new responsibilities and aims as the appointing person from 1 April 2018, and of the conclusion of the transitional arrangements put in place in April 2015 by the Secretary of State. Twelve staff transferred to PSAA on closure of the Audit Commission at the end of March 2015 to undertake the work required to manage the novated audit contracts under these transitional arrangements, covering principal NHS and local government bodies and smaller local government bodies, and providing housing benefit subsidy certification on a transitional basis for the Department for Work and Pensions.

As a result of the restructuring exercise, the number of staff employed by the company will reduce to six during 2018/19, and will enable the company to fill the posts in its new structure with the specific skills and experience its new responsibilities require. The exercise has enabled a significant reduction in the company’s cost base for the appointing period and has contributed to the reduction of 23 per cent in the fee scale for 2018/19.

Lessons learned review

PSAA is undertaking an important piece of work to understand what worked well in the appointing person project and to identify areas for improvement for the future. The review will be completed in 2018/19 and includes both an internal lessons learned review, covering the opt-in invitation and procurement process, and a comprehensive project review following the completion of the fee setting process in March 2018. The review is being undertaken with the support of Cardiff Business School.

Procurement award finalist

PSAA was pleased to be highly commended in the category of Outstanding Procurement Initiative of the year in the 2018 Public Finance Innovation Awards, and to be shortlisted for the Government Opportunities public procurement awards 2018/19, for our procurement of audit services for the 484 opted-in principal authorities in England.

Office accommodation

In October 2016 PSAA moved with the Local Government Association (LGA) to temporary office accommodation in Farringdon, London while its permanent base in Westminster was refurbished. We returned to Westminster in November 2017 and continue to be co-located with the LGA, enabling close co-operation on our appointing person responsibilities.

3. Risks and future developments

Risk management

The objectives of PSAA’s risk management arrangements are to:

- maintain a risk management framework which provides assurance to the Board that strategic and operational risks are being managed effectively;

- ensure that risk management is an integral part of PSAA’s operations;

- contribute to making informed decisions and effective resource planning; and

- inspire trust and confidence in our key stakeholders.

In relation to risk management, the Board is responsible for taking a balanced view of the company’s approach to managing opportunity and risk. The Board’s responsibility includes:

- ensuring that effective arrangements are in place to provide assurance on risk management, governance and internal control;

- ensuring that the risks it faces are dealt with in an appropriate manner, in accordance with relevant aspects of best practice in corporate governance; and

- approving the risk management strategy.

The Board is also responsible for setting the company’s overall corporate risk appetite. As a company responsible for handling public money, PSAA’s tolerance of risk is generally low or medium.

The PSAA audit committee is responsible for reviewing and challenging the company’s assessment and management of risk and the adequacy of internal controls established to manage strategic and operational risks identified. The audit committee scrutinises the corporate risk register, and may ask for further reports or presentations on specific risks as it considers necessary. The audit committee reports to the Board on risk management.

The Chief Officer is responsible for maintaining the company’s system of internal control and assurance framework, providing the Board and audit committee with assurance on the system’s ongoing effectiveness and appropriateness, and advising the Board and audit committee as to material changes. The PSAA management team reviews the corporate risk register and named members of the management team are responsible for managing the individual risks.

During 2017/18, PSAA managed an average of 12 risks in the corporate risk register. The Board undertook a strategic review of our risks in the context of its appointing person responsibilities from 2018/19. This review was designed to ensure that the company’s rigorous approach to risk management is appropriately focused on our future remit.

In addition to the strategic review, the audit committee reviewed the risk register on a quarterly basis. The residual principal risks facing PSAA are that:

- PSAA is going through a major business re-organisation which may lead to disruption to its operations; and

- the security of PSAA’s data may be compromised, taking into account the contracting-out of data processing to the LGA and by the LGA to the London Borough of Brent.

These risks have the potential to impair PSAA’s ability to deliver its statutory functions efficiently and effectively. The audit committee and the Board are sighted in relation to these risks and are satisfied that the arrangements in place to manage them are robust.

Future developments

The financial year 2018/19 will be significant for PSAA. We will:

- begin operating our appointing person responsibilities from 1 April 2018, for the appointing period covering the accounts of relevant authorities for 2018/19 to 2022/23;

- hold the inaugural meeting of the Local Audit Quality Forum in April 2018, and establish a forward programme for the forum;

- complete the staff restructuring, which contributes significantly to the company’s overall cost reductions; and

- oversee delivery of the final audits under the transitional arrangements.

4. Financial review

Being financially responsible

PSAA is committed to securing value for money, ensuring it delivers its objectives while minimising costs. The company strives to ensure that PSAA is financially responsible by:

- exercising financial discipline and maintaining a robust control environment;

- keeping running costs to a minimum;

- returning surplus funds to audited bodies;

- ensuring the company’s internal auditors review the internal control environment annually to provide assurance on the financial controls and confirm these are working as intended;

- meeting the company’s statutory obligations; and

- meeting PSAA’s duties as a good employer.

The company’s internal auditors, TIAA Limited, have reported substantial assurance on all areas reviewed, covering: PSAA’s management of income flows (WIP), governance framework, members and staff expenses, and bank reconciliations.

Turnover and profit on ordinary activities

The revenue received by PSAA must cover the costs of paying auditors for work under the audit contracts and the operating expenses of PSAA.

PSAA’s accounts show a £nil profit for the 12 months to 31 March 2018 as revenue is matched to expenditure and any monies not required to cover costs are returned to audited bodies.

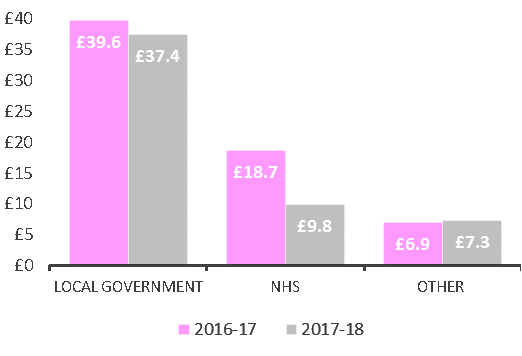

Revenue, including investment income, for the 12 months to 31 March 2018 was £54.547 million (2016/17 £65.277 million) which covered the costs including corporation tax incurred by PSAA for the period 1 April 2017 to 31 March 2018 of £54.547 million (2016/17 £65.277 million). The reduction in revenue and associated costs is mainly because of the completion of our responsibilities for NHS audits.

Revenue by sector – £m

Controlling Costs

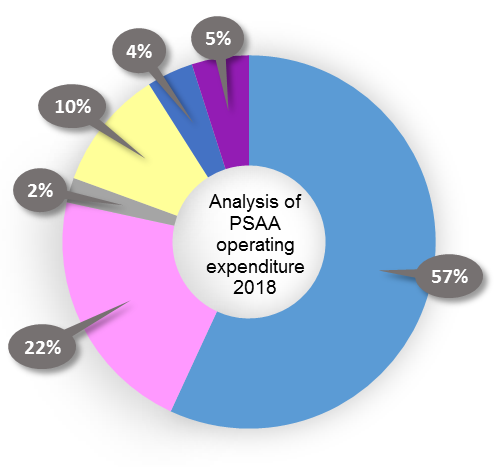

PSAA incurred total costs of £54.547 million, of which the cost of the novated audit contracts for the period were £51.624 million, 94.6%of total costs (2016/17: £63.051 million which represented 96.6%). PSAA incurred operating expenses of £2.918 million in 2017/18 which represents 5.4% of total costs (2016/17: £2.220 million which represented 3.4% of total costs) and taxation of £0.005 million (2016/17: £0.006 million).

Analysis of operating expenditure

Financial position

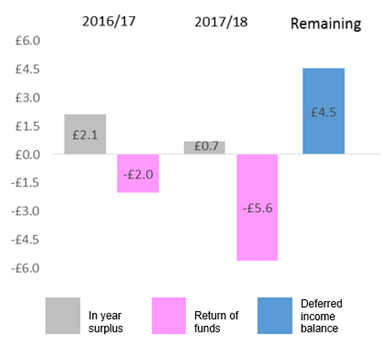

PSAA is required to pay any surplus funds to principal audited bodies, as provided for in its articles of association and the memorandum of understanding with MHCLG and other parties. Surplus funds are shown as a liability in the balance sheet as part of deferred income. The deferred income is regularly reviewed to ensure PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. Funds no longer required are returned once approved by the Board. At the end of 31 March 2018 the surplus funds remaining were £4.5 million. This reflects the Board’s decision to return £5.6 million in December 2017 to local government and police bodies, following a return of funds to NHS bodies in 2016/17.

Movement in deferred income (excluding WIP) at the end of the financial year against return of funds to NHS, police and local government bodies – £m

By order of the Board

Steve Freer

Chairman

18 July 2018