Strategic report

1. Objectives and operating environment

The directors present their strategic report for the year ended 31 March 2019.

PSAA’s responsibilities derive from provisions of the Local Audit and Accountability Act 2014 and the Local Audit (Appointing Person) Regulations 2015 made under that Act. The company is specified as an appointing person for principal local government bodies, including local police bodies. These responsibilities became operational from 1 April 2018, and are the focus of the company’s purpose from that date. PSAA’s responsibilities and aims are expressed through a series of objectives, covering:

- appointing auditors to relevant authorities;

- consulting on and setting a scale or scales of fees, and charging fees, for the audit of accounts of relevant authorities;

- ensuring that public money from audit fees continues to be accounted for properly and is protected;

- overseeing the delivery of consistent, high quality and effective audit services to relevant authorities;

- ensuring effective management of contracts with firms for audit services to relevant authorities;

- being financially responsible having regard to the efficiency of operating costs and transparently safeguarding fees charged to audited bodies; and

- leading its people as a good employer.

A memorandum of understanding with the Ministry of Housing, Communities and Local Government sets out the broad framework in which PSAA operates. The memorandum contains the agreed principles regarding PSAA’s operation and the mechanisms for its accountability for, and safeguarding of, public money in the form of audit fees charged to audited bodies.

The 2018/19 financial year saw the completion of audits under the previous statutory framework for audits of local public bodies. These responsibilities were delegated to the company on a transitional basis following the closure of the Audit Commission in 2015.

The PSAA Board believes that strong corporate governance supports the future long-term success of PSAA and has established a comprehensive governance framework to support its functions as an appointing person. The Board takes very seriously its duty under Section 172 of the Companies Act 2006 to promote the success of the company. The Act states that ’A director of a company must act in the way he considers, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole, and in doing so have regard (amongst other matters) to:

- the likely consequences of any decision in the long term;

- the interests of the company’s employees;

- the need to foster the company’s business relationships with suppliers, customers and others;

- the impact of the company’s operations on the community and the environment; and

- the desirability of the company maintaining a reputation for high standards of business conduct.

PSAA is wholly owned by the Improvement and Development Agency (IDeA). IDeA is the company’s sole member. As founder of the company IDeA’s role is to support PSAA in discharging its functions and achieving its objectives. The IDeA acknowledges the independence of the company and the responsibility for running the company as that of PSAA and the Board. The Board has satisfied itself that consideration of the requirements of Section 172, and the directors’ duties under it, have informed and guided the Board’s work in the past year.

The following explains how we consider we have had regard to promoting the success of the company in relation to each of the specific requirements of Section 172.

(a) The likely consequences of any decision in the long term

The Board considers how to promote the long-term success of the organisation on a continuous basis, providing effective leadership and oversight of PSAA as it seeks to achieve its objectives. Its decision making is influenced by active consideration of PSAA’s position, role and relationships within the new local audit system as a whole. The Board is mindful of the fact that PSAA’s success depends to a large extent upon the ability of the larger system to deliver for and meet the needs of audited bodies and users of audited accounts.

This year, the Board commissioned the CBS review of our work to design and implement our appointing person arrangements in order to seek the views of audited bodies and other stakeholders and help identify improvements to be implemented during this appointing period, and longer term changes for consideration in relation to the next appointing period, commencing in 2023/24.

CBS’s report concluded that PSAA had produced a well thought through, organised, and governed programme which delivered substantively on its objectives to the benefit of local bodies. While CBS highlighted that there was general satisfaction from opted-in bodies with our arrangements, there are some key messages and challenges to address. We will address the report’s recommendations and engage with our stakeholders to ensure that our future work programmes are also informed by their views and priorities.

Our 5 year Medium Term Financial Plan (MTFP) reflects a healthy financial position. PSAA operates on a not-for-profit basis. From time to time the Board approves the distribution of surplus funds to audited bodies. The transitional arrangements (2015-18) and now current appointing person arrangements are accounted for separately in the MTFP. The Board reviews the company’s financial position at every Board meeting, including the most up-to-date forecast. We approve our annual accounts following detailed scrutiny by, and a recommendation to do so from, the audit committee. Our treasury management policy is also reviewed annually by the audit committee which makes recommendations to the Board as appropriate.

As a Board we are responsible for overseeing the company’s arrangements for risk management, identifying key risks, considering risk appetite, and agreeing appropriate mitigation strategies. More detail on our risk management processes is included in Section 3 of the Strategic Report.

All decisions are taken with due regard to the company’s purpose and objectives (as set out in the Articles of Association and other operating documents), the effective and efficient use of public funds and the need to ensure delivery of high quality and cost-effective audit services.

(b) The interests of the company’s employees

We aim to be a good employer, encouraging a culture of openness and transparency, developing people to the best of their abilities and offering competitive remuneration and benefits to recruit and retain staff. The Board recognises that our small team of well qualified staff are crucial to the success of PSAA.

We completed a significant staff restructuring exercise in 2018/19, to align the number and skills of staff with our business needs. The restructure was undertaken in the context of the company’s new responsibilities and aims as an appointing person from 1 April 2018, and of the conclusion of the transitional arrangements put in place in April 2015. As a result of the restructure we incurred redundancy costs, which are included in the remuneration report.

Twelve staff transferred to PSAA on the closure of the Audit Commission at the end of March 2015, to undertake the work required on a transitional basis to manage the novated audit contracts relating to principal NHS, local government, police and fire bodies, smaller local government bodies (town and parish councils), and providing housing benefit subsidy certification for the Department for Work and Pensions. The restructuring has reduced the number of PSAA staff to six, establishing a team which has the right skills and experience for the company’s new role, and contributing to savings of £370,000 per annum (39%) in our cost base.

The management of change was implemented in consultation with all staff and included a review of the rates of pay, benefits and terms and conditions. We will continue to monitor the pay and benefits package with reference to market rates and company requirements.

We are committed to developing our staff and enabling them to realise their potential. During 2018/19 the focus has been on bedding in the new structure and developing the team in their new roles. New staff have received induction training and tailored development programmes are being put in place to support individual staff needs as appropriate.

To ensure that the new structure has bedded in successfully, the Board monitors the organisational work streams and capacity via regular updates from the Chief Executive. All staff are familiar with and observe the company’s staff code of conduct which is accessible on PSAA’s intranet.

With a small team, good communication is imperative. Board and audit committee papers are accessible to all staff. All employees are kept up to date with items considered at Board meetings and in relation to PSAA’s finances, and these are standing agenda discussion items at team meetings.

(c) The need to foster PSAA’s business relationships with suppliers, customers and others

Positive business relationships are recognised to be critical to the company’s future success. The Board is committed to building and maintaining strong, effective links with other organisations which perform specialist roles in the new local audit system so that the system as a whole operates efficiently and in a way that meets the needs of audited bodies and users of accounts. Relationships with audit providers are also vitally important. Local audit requires specialist knowledge and expertise. Retaining existing suppliers and, if possible, encouraging new firms to enter will help to ensure that the market remains sustainable and competitive. Close links and open communications with audited bodies will enable us to understand and better meet their needs. The Board is very keen to maintain the current high proportions of eligible bodies opting into the PSAA scheme. The structure of the scheme is such that high levels of participation increase the benefits for each and every participant.

The long-term success of PSAA is therefore critically dependent on the way we work with our customers, suppliers and other stakeholders. As part of the Lessons Learned review, CBS invited stakeholders to participate in surveys and workshops providing views about different aspects of PSAA’s services and activities.

Our customers

Our customers under the appointing person arrangements are opted-in local authorities, police and fire authorities. We operate on a not-for-profit basis, and any surpluses are returned to the audited bodies.

The views of our customers are very important to us and we aim to understand their priorities. We engage with our customers through a variety of different means:

- We have established an Advisory Panel, whose members represent the different types of opted-in bodies. This forum provides helpful feedback and insights into all aspects of our policy making and has enabled PSAA to consult stakeholders and adopt approaches which work for opted-in bodies.

- We are responsive to concerns raised by opted-in authorities. The Lessons Learned review raised some concerns in relation to the possible impact of audit fee reductions on the quality of audits. In our view these fears are misplaced. During the procurement process conducted by PSAA, firms were able to bid freely for a variety of different lot sizes. Following the award of contracts, suppliers are being remunerated in accordance with their successful bids. Subsequent reductions to the audit fees payable by audited bodies have no impact upon the remuneration of firms. Audit fee reductions are possible as a result of the range of successful bids submitted and the significant savings in PSAA’s cost base. The company has in place a robust quality monitoring regime which is subject to regular review. We report publicly on PSAA’s website on quality and promptly follow up on any issues reported to us by customers.

- We ensure that all stakeholders have sufficient time to respond to our consultations, for example, in relation to fees and appointments.

- We have established the Local Audit Quality Forum (LAQF) to support the role of audit committees of opted-in bodies in relation to audit quality. Our commitment to audit quality for opted-in bodies will feature strongly in our work going forward. We believe that the forum provides a meeting place in which all of the parties that have a responsibility for audit quality can share experiences and good practice. In particular we aim to help local audit committees to play their critical and demanding roles effectively. We hope that audit committee chairs and chief finance officers will be regular attendees and active participants in LAQF events.

- Annually we will survey customers as part of our monitoring regime concerning the quality of the services they are receiving.

- We will continue to work on enhancing our communications with customers as we consider this to be a prerequisite for our continued success.

- Relevant bodies are consulted in relation to any changes to or new auditor appointments in accordance with PSAA’s governance framework.

Our suppliers

Our main suppliers are the audit firms with whom we contract to provide audit services to our customers. The development of strong, long-term relationships with audit firms is not only critical for delivering high quality audit services under the current contract but also for future sustainability of the local audit market.

During the course of audits of 2018/19 accounts, it has become apparent that some firms are experiencing difficulties resourcing all of the audits for which they are responsible on a timely basis, to enable audited accounts to be published by the target date of 31 July 2019. The new earlier target deadline for publication has significantly reduced the time available for firms to carry out their post-year end examination of draft accounts leading up to the issue of the final audit opinion. Staff recruitment and retention have proved to be major challenges in the current climate in which the value of audit and the role of auditors is being widely questioned. There is no statutory deadline for the publication of audited accounts but all parties – audited bodies, firms and PSAA – are committed to meeting the 31 July target deadline wherever possible. PSAA is disappointed that these difficulties have arisen and is committed to finding solutions which will avoid similar issues arising in future years. We are very conscious of the disappointment of audited bodies whose audited accounts cannot be published by 31 July and of the disruptive impact on the work plans of those bodies of rescheduling their audits. We are discussing with the firms concerned their plans to complete the audits as soon as possible and to avoid a repetition of such problems in the future.

PSAA meets regularly with audit suppliers both individually and as a group. This facilitates discussion of issues of common concern. We recognise that it is important that PSAA’s arrangements and contracts, and the wider local audit system, work satisfactorily for audit firms, encouraging their long term commitment to the sector.

To provide transparency and encourage best practice, we publish quality monitoring reports on PSAA’s website on the performance of each of our contracted firms and the quality of the audits they deliver.

PSAA staff has ongoing communication with firms and audited bodies to agree fee variations. Latest fee variation information is included in the quarterly quality reports that are presented to us for our review.

PSAA participates in the groups established to manage the implementation and delivery of the Local Audit and Accountability 2014 (LAAA 2014): the Ministry of Housing, Communities and Local Government (MHCLG) Delivery Board, its local audit sub-group and NAO’s Local Audit Advisory Group. These groups include representatives of the firms, the regulatory bodies and government departments.

PSAA staff carry out annual monitoring of each contracted firm addressing both financial health and significant threats to reputation which might be relevant to the firm’s contractual responsibilities to PSAA. The results of this work is reported to the Board by the Chief Executive.

Other key suppliers of services to the company are: the Local Government Association who provide us with our back office services and accommodation; the Financial Reporting Council (this contract ceases in 2019) who provide independent quality review services; and CIPFA who provide technical reports and publications. PSAA staff meet regularly with these suppliers to ensure positive relationships and early resolution of any concerns.

Wherever feasible, we use the services of smaller suppliers to support the general day to day running of our business.

Other stakeholders

Given our unique position within the local audit environment, we work with a number of key stakeholders and regulators to ensure the quality of local audit services, and are represented on various key fora.

Our other main stakeholders include MHCLG, the National Audit Office, the FRC, ICAEW, CIPFA and DWP. The Chairman and the Chief Executive attend meetings held by MHCLG, and officers attend meetings with the other stakeholders as appropriate, with updates in the Chief Executive’s regular reports to the Board.

PSAA has provided support to the DWP in developing their arrangements for housing benefits certification from 2018/19 onwards but has no role with respect to the implementation and ongoing operation of those arrangements.

We also engage with sector wide initiatives and contribute views and information for national reviews and studies. During 2018/19 we contributed to separate reviews led by Sir John Kingman and The Competition and Markets Authority. Going forward we have identified the NAO’s review of the Code of Audit Practice for local audit and the MHCLG commissioned post implementation review of the LAAA 2014 as key developments which PSAA must actively support with a view to securing positive outcomes for audited bodies and users of accounts.

(d) The impact of the company’s operations on the community and the environment

The Board regards local audit as an important cornerstone of local accountability. PSAA’s most significant contribution to the community therefore lies in its responsibility to ensure that affordable, high quality audits continue to be delivered to each and every opted-in body by competent suppliers.

The LGA provides a range of support services to the company, including provision of serviced accommodation, HR, and payroll support. As well as operating efficiencies and economies of scale, this arrangement enables PSAA to subscribe to and participate in a range of LGA policies and initiatives. These include an apprentice scheme (LGA currently have 10 apprentices), ways of working which encourage working from home and a reduction in printing, an office recycling scheme, and use of energy efficient office equipment.

PSAA is wholly owned by the Improvement and Development Agency (IDeA) and we have embraced its environmental policy, which includes a commitment to reduce our environmental footprint by:

- continually reducing waste and increasing recycling rate;

- reducing paper use;

- ensuring that procurement of goods and services adheres to the green purchasing and procurement policy; and

- complying with all applicable legislation, regulation and other relevant requirements relating to our environmental impacts.

Our appointing person procurement scheme required suppliers to identify the social value benefits which would accrue from any contract award. This secured commitments to apprenticeships, training and other arrangements which are included in firms’ method statements. Our on-going monitoring of the contract reviews performance against this commitment.

Customers and their local communities will benefit from the significant cost savings realised from our procurement exercise and the re-structuring of PSAA and the related review of our cost base.

The Board has approved a statement on modern slavery which is published on the website and staff have completed appropriate training.

(e) The desirability of PSAA maintaining a reputation for high standards of business conduct

High standards of corporate governance are a key factor in underpinning the integrity and efficiency of PSAA. We believe that they are critical in helping us to achieve our core objectives as set out in our Articles of Association. Our arrangements draw on a number of good practice sources including the principles set out in the Code of Conduct for Board Members of Public Bodies (issued by the Cabinet Office) and in the UK Corporate Governance Code, to the extent that the latter can be applied to a small company without shareholders. We review our corporate governance framework annually to ensure it remains fit for purpose and publish full details on our website.

Board Recruitment

Our Chairman is appointed by the IDeA and other non-executive Directors are appointed by the Chairman. The Chairman leads the process for Board appointments and makes relevant recommendations to the IDEA. The Board also considers Board succession planning and the leadership needs of PSAA.

Our staff

Our recent restructure was designed to ensure PSAA is fit for purpose to fulfil the company’s new appointing person responsibilities. The roles in the new organisational structure are filled by candidates with the necessary skills, qualifications and experience. Most PSAA staff are members of professional accountancy bodies. We encourage and fund staff to attend training and maintain continuing professional development (CPD).

Our stakeholders

We aim to be as transparent as possible about our business, finances, statutory responsibilities and governance including making information available in accordance with the Local Government Transparency Code. PSAA’s website provides detailed information about the company and its functions including:

- Articles of association;

- Audit committee terms of reference;

- Directors’ interest and gifts and hospitality;

- Annual report and accounts;

- Quarterly spend data; and

- PSAA’s consultation policy which is based on the principles published by the Cabinet Office.

Corporate Governance framework

PSAA has established a robust corporate governance framework which is regularly reviewed. Further details are included in Section 3 of the Strategic Report on Risk Management and within the Governance Report.

The Board is committed to continuing to assess and review its performance and arrangements in relation to the framework as we transition from a regulatory body exercising powers delegated by the Secretary of State to an organisation operating as a specified appointing person under the Local Audit and Accountability Act 2014.

2. Business review

Auditor appointments

In our fourth full year of business, covered by this report, the company has focused on embedding the arrangements to discharge its appointing person responsibilities.

Auditor appointments for the current five-year appointing period began with effect from 1 April 2018. We had confirmed all appointments to opted-in bodies in December 2017, following a major procurement exercise. In order to be eligible for our contracts, firms must be approved by a relevant recognised supervisory body and, as at 31 March 2019, five approved suppliers are contracted to provide audit services to opted-in bodies.

| Lot | Firm | PSAA market share |

| 1 | Grant Thornton UK LLP | 40% |

| 2 | Ernst and Young LLP | 30% |

| 3 | Mazars LLP | 18% |

| 4 | BDO LLP | 6% |

| 5 | Deloitte LLP | 6% |

Appointments have been made for the five years of the appointing period, covering audits of the accounts of opted-in bodies for 2018/19 to 2022/23.

At 31 March 2019 there were 497 local government bodies eligible to opt into the PSAA scheme, 486 (98%) of which had opted in. This high level of support from eligible bodies has enabled us to offer a scheme which maximises benefits and provides excellent value for money for participating bodies.

There have been some minor changes in the number of bodies eligible to opt in. A small number has either ceased to exist or been created (such as new Fire and Rescue Commissioning Authorities). There will be further movement for 2019/20 and 2020/21, as various council re-organisations are implemented, and other proposals progress.

Setting audit fees

PSAA’s statutory appointing person responsibilities include specifying a scale or scales of fees for the audit of accounts of opted-in bodies. Before setting a scale of fees, we are required to consult opted-in bodies, appropriate representative associations of principal authorities and appropriate bodies of accountants.

PSAA set the 2019/20 fee scale on the basis that individual scale fees for all opted-in bodies are maintained at the same level as 2018/19 unless there are specific circumstances which require otherwise. Opted-in bodies therefore continue to enjoy the benefit of the cost savings achieved in the audit procurement as well as those arising from PSAA’s own restructuring. We have also continued the practice of averaging firms’ costs so that all bodies benefit from the same proportionate savings, irrespective of the firm appointed to audit a particular opted-in body.

We consulted on our proposal to maintain scale fees and reiterated our commitment to try if possible to maintain fee stability throughout the current appointing period. We received 30 responses to our consultation and the vast majority supported our proposals. We published the confirmed 2019/20 fee scale in March 2019.

There were a range of issues raised in consultation responses. The Board has considered a number of the points made by opted-in bodies and our contracted audit firms and has decided to carry out further analysis and research to develop an in-depth understanding of the concerns raised. We have thanked those who responded to our consultation and replied individually where responses requested clarification or further information.

We will continue to review scale fees each year as we update our assumptions and estimates. The most significant variables which are likely to influence our decision-making are:

- Inflation: our contracts with audit firms include provision for inflation adjustments in the later years of the appointing period.

- Code of Audit Practice: the National Audit Office is required to publish a new Code every five years. The next Code will be applicable from 2020/21, the third year of the appointing period. Any changes to the approach required from auditors, whether this increases or decreases the work required, will need to be reflected in scale fees.

- Changes in financial reporting requirements: current scale fees reflect audit work based on current financial reporting requirements. Changes to those requirements may have an impact on scale fees. However, as the impact of standards may vary between bodies and periods, it may be the case that individual fee variations will be more appropriate.

Audit quality

PSAA is committed to ensuring that its contracted firms provide good quality audits for opted-in bodies. During 2018/19 we have undertaken a careful review and developed new arrangements for monitoring audit quality and contract compliance during the five-year appointing period.

We have adopted the International Auditing and Assurance Standards Board’s Framework for Audit Quality (the IAASB framework) as the model for the appointing person audit quality arrangements. Audit quality formed a core part of the evaluation of tenderers in the 2017 audit services procurement, with tenderers encouraged to have regard to the IAASB framework in their responses. Ongoing contract management arrangements have the dual purpose of reporting results to opted-in bodies, and ensuring that PSAA meets its obligations under the Local Audit (Appointing Person) Regulations 2015 to monitor compliance of auditors against the requirements in the audit contracts.

Our approach is based on the expectation that a quality audit is likely to be achieved by an engagement team that:

- exhibits appropriate values, ethics and attitudes;

- is sufficiently knowledgeable, skilled and experienced and has sufficient time allocated to perform the audit work;

- applies a rigorous audit process and quality control procedures that comply with law, regulation and applicable standards;

- provides useful and timely reports; and

- interacts appropriately with relevant stakeholders.

While responsibility for providing a quality audit rests ultimately with the auditor, audit quality, efficiency and effectiveness are shared responsibilities. The IAASB framework notes that all parts of the financial reporting supply chain (including audit firms, regulators, standard setters and audit committees) have a role in contributing to and encouraging an audit environment that supports high quality audits.

End of transitional arrangements

The company has been responsible since 1 April 2015 for specific functions delegated to it on a transitional basis by the then Secretary of State for Communities and Local Government. These responsibilities included appointing auditors and setting fees for principal local government and NHS bodies and for making arrangements for housing benefits subsidy claim certification, managing contracts novated to PSAA on the closure of the Audit Commission in March 2015.

The final elements of this work related to the 2017/18 audits of local government bodies, undertaken during 2018/19. During 2019/20 there will be a distribution of surplus income after PSAA expenses for this period to the relevant audited bodies.

3. Risk Management

Risk management arrangements

The objectives of PSAA’s risk management arrangements are to:

- maintain a risk management framework which provides assurance to the Board that strategic and operational risks are being managed effectively;

- ensure that risk management is an integral part of PSAA’s operations;

- contribute to making informed decisions and effective resource planning; and

- inspire trust and confidence amongst our key stakeholders.

In relation to risk management, the Board is responsible for taking a balanced view of the company’s approach to managing opportunity and risk. The Board’s responsibility includes:

- ensuring that effective arrangements are in place to provide assurance on risk management, governance and internal control;

- ensuring that the risks it faces are dealt with in an appropriate manner, in accordance with relevant aspects of best practice in corporate governance; and

- approving the risk management strategy.

The Board is also responsible for setting the company’s overall corporate risk appetite. As a company responsible for handling public money, PSAA’s tolerance of risk is generally low.

The PSAA audit committee is responsible for reviewing and challenging the company’s assessment and management of risk and the adequacy of internal controls established to manage strategic and operational risks identified. The audit committee scrutinises the corporate risk register, and may ask for further reports or presentations on specific risks as it considers necessary. The audit committee reports to the Board on risk management.

The Chief Executive is responsible for maintaining the company’s system of internal control and assurance framework, providing the Board and audit committee with assurance on the system’s ongoing effectiveness and appropriateness, and advising the Board and audit committee as to material changes.

The PSAA team reviews the corporate risk register on a regular basis and specific members of the management team are responsible for managing the individual risks. The team review each of the risks to ensure that the actions identified are up to date/remain appropriate and considers whether there are any new risks that should be added to the risk register.

Current risks

During 2018/19, PSAA managed an average of 8 risks in the corporate risk register and the audit committee reviewed the risk register at each meeting.

PSAA undertook a review of its risks in the context of the company commencing its appointing person responsibilities, and as such moving away from the regulatory role that existed under the transitional arrangements. This review was designed to ensure that the company’s risk management approach (Strategy and corporate risk register) was still fit for purpose.

Some of the key risks facing PSAA are that:

- the audit suppliers fail to meet PSAA’s contractual requirements, either in terms of delivery or quality;

- PSAA fails to maintain suitable relationships with existing and potential audit suppliers; and

- in the next appointing period it may not be possible to maintain the current high level of opting in by eligible authorities.

These risks have the potential to impair PSAA’s ability to deliver its functions efficiently and effectively. The audit committee and the Board are sighted in relation to these risks and are satisfied that the arrangements in place to manage them are robust.

Future risks

There are also a number of wider challenges which have the potential to impact on local audit, audited bodies and PSAA. These include:

- possible changes in audit regulation, auditing standards and audit firms;

- the challenge of ensuring that the local audit system as a whole works effectively and meets the needs of audited bodies and users of accounts;

- the need to maintain a sustainable, competitive local audit market; and

- the related challenge to ensure an adequate supply of suitably qualified and experienced audit staff.

PSAA is seeking to raise the profile of these issues with other stakeholders in the local audit system and is commissioning research and other work to explore options to address these important challenges.

4. Financial review

Being financially responsible

PSAA is committed to securing value for money, ensuring it delivers its objectives while minimising costs. PSAA strives to be financially responsible by:

- exercising financial discipline and maintaining a robust control environment;

- keeping running costs to a minimum;

- returning surplus funds to audited bodies;

- ensuring the company’s internal auditors review the internal control environment annually to provide assurance on the financial controls and confirm these are working as intended;

- meeting the company’s statutory obligations; and

- meeting PSAA’s duties as a good employer.

The company’s internal auditors, TIAA Limited, have reported substantial assurance on all areas reviewed, covering: General Data Protection Regulation implementation, risk management arrangements, redundancy payments, and the calculation of Audit Firms’ remuneration rates.

Turnover and profit on ordinary activities

The revenue received by PSAA must cover the costs of paying auditors for work under the audit contracts and the operating expenses of PSAA.

PSAA’s accounts show a £nil profit for the 12 months to 31 March 2019 as revenue is matched to expenditure and any monies not required to cover costs are returned to audited bodies.

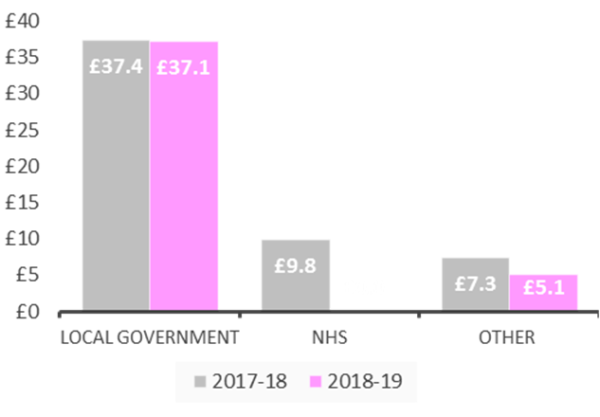

Revenue, including investment income, for the 12 months to 31 Mar 2019 was £42.214 million (2017/18 £54.547 million) which covered the costs including corporation tax incurred by PSAA for the period 1 April 2018 to 31 March 2019 of £42.214 million (2017/18 £54.547 million).

The reduction in revenue and associated costs is mainly because of the near completion of our responsibilities for NHS audits and smaller local government bodies.

Controlling costs

PSAA incurred total costs of £42.214 million, of which the cost of the novated audit contracts for the period was £40.612 million, 96.2% of total costs (2017/18: £51.624 million which represented 94.6%).

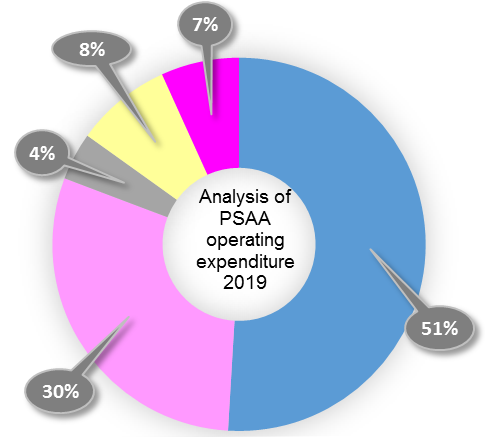

PSAA incurred operating expenses of £1.595 million in 2018/19 which represents 3.8% of total costs (2017/18: £2.918 million which represented 5.4% of total costs) and taxation of £0.007 million (2017/18: £0.005 million).

Financial position

PSAA’s total assets equal total liabilities at the end of 31 March 2019 (31 March 2018: total assets also equalled total liabilities). PSAA is required to pay any surplus funds to principal audited bodies, as provided for in its articles of association and the memorandum of understanding with MHCLG and other parties. Surplus funds are shown as a liability in the balance sheet as part of deferred income. The deferred income is regularly reviewed to ensure PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. Funds no longer required are returned once approved by the Board. At the end of 31 March 2019, the surplus funds remaining were £6.1 million. In the short term, the Board plans to distribute in the region of £3.5m to audited bodies under the transitional arrangements as the majority of these audits were completed by 31 March 2019. The final decision on the amount and timing of the distribution will be made towards the end of 2019. It is expected to leave approximately £2.6 million in the long term deferred income (note 13).

Future developments

The financial year 2019/20 will be a significant one for local audit and PSAA in that:

- during 2019 appointed auditors will complete the first audits under the appointing person contracts;

- the National Audit Office will consult on the new Code of Audit Practice that will apply for five years from 2020/21 and this may have an impact on the work to be carried out under our audit contracts and the associated fee scale for the remaining three years of the appointing period;

- MHCLG is committed to carrying out an important post implementation review of the LAAA 2014 which may have implications for local audit arrangements going forward; and

- we are planning to undertake a number of projects to explore key issues in relation to local audit. Some of these link to the recommendations from our lessons learned project, while others arise from responses to the consultation on scale fees. The Board is also committed to exploring solutions to some of the wider challenges facing the local audit system.

Audit is increasingly in the public eye. Sir John Kingman has reported on the regulation of the audit market which has led to plans to replace the FRC, while the Competition and Markets Authority has put forward proposals to increase auditor competition. Meantime Sir Donald Brydon is now reviewing what is meant by an audit and the Public Accounts Committee are showing a keen interest in the results of local auditors’ work. We will be monitoring all of these developments and assessing their potential impact on local audit, the company, opted-in bodies and contracted audit firms.

By order of the Board

Steve Freer

Chairman

17 July 2019