Strategic report

1. Objectives and operating environment

The directors present their strategic report for the year ended 31 March 2021.

PSAA’s responsibilities and aims are expressed through a series of objectives and are set out in our Articles of Association, covering the following areas of activity:

- appointing auditors to relevant authorities;

- consulting on and setting a scale or scales of fees, and charging fees, for the audit of accounts of relevant authorities;

- ensuring that public money from audit fees continues to be accounted for properly and is protected;

- overseeing the delivery of consistent, high quality and effective audit services to relevant authorities;

- ensuring effective management of contracts with firms for audit services to relevant authorities;

- being financially responsible having regard to the efficiency of operating costs and transparently safeguarding fees charged to opted-in bodies; and

- leading our people as a good employer.

A memorandum of understanding with the MHCLG sets out the broad framework in which PSAA operates for the transitional arrangements. It contains the agreed principles regarding PSAA’s operation and the mechanisms for its accountability for, and safeguarding of, public money in the form of audit fees charged to opted-in bodies. An updated MoU will be agreed to support the delivery of a positive outcome at the next procurement.

The PSAA Board believes that strong corporate governance supports the future long-term success of PSAA and has established a comprehensive governance framework to support its functions as an appointing person. The Board takes very seriously its duty under Section 172 of the Companies Act 2006 to promote the success of the company. The Act states that ’A director of a company must act in the way he considers, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole, and in doing so have regard (amongst other matters) to:

- the likely consequences of any decision in the long term;

- the interests of the company’s employees;

- the need to foster the company’s business relationships with suppliers, customers and others;

- the impact of the company’s operations on the community and the environment; and

- the desirability of the company maintaining a reputation for high standards of business conduct.’

PSAA is wholly owned by the Improvement and Development Agency (IDeA). IDeA is the company’s sole member. As founder of the company IDeA’s role is to support PSAA in discharging its functions and achieving its objectives. The IDeA acknowledges the independence of the company and the responsibility for running the company as that of PSAA and the Board.

The Board has satisfied itself that consideration of the requirements of Section 172, and the directors’ duties under it, have informed and guided the Board’s work in the past year. The following explains how we consider we have had regard to promoting the success of the company in relation to each of the specific requirements of Section 172.

(a) The likely consequences of any decision in the long term

The Board considers how to promote the long-term success of the organisation on a continuous basis, providing effective leadership and oversight of PSAA as it seeks to achieve its objectives. Its decision making is influenced by active consideration of PSAA’s position, role and relationships within the local audit system as a whole. The Board is mindful of the fact that PSAA’s success depends to a large extent upon the ability of the larger system to deliver for and meet the needs of opted-in bodies and users of audited accounts. To achieve this, PSAA meets and works closely with other key players in the local audit system seeking to influence decisions for improvement of the system overall.

We attend the Forum for Local Audit Regulation in England (FLARE) along with representatives of government departments, the NAO, the FRC, ICAEW, CIPFA, and representatives of audit firms. The forum was established in May 2020 to focus on measures which can be taken co-operatively to strengthen both the local audit market and system.

During the year we have developed and approved our Business Plan, which sets out our plans for the next year. The plan is designed to be flexible to respond to system and market developments as well as any relevant Government decisions. It is regularly monitored by the Board against a suite of KPIs. Alongside the Business Plan we have also developed and approved a Communications Strategy.

Our 5-year Medium Term Financial Plan (MTFP) reflects a healthy financial position. PSAA operates on a not-for-profit basis. From time to time the Board approves the distribution of surplus funds to opted-in bodies after ensuring PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. The transitional arrangements (2015-2018) and current appointing person arrangements are accounted for separately in the MTFP. The Board regularly reviews the company’s financial position at Board meetings, including the most up-to-date forecast. We approve our annual accounts following detailed scrutiny by and a recommendation to do so from the audit committee. Our treasury management policy is also reviewed annually by the audit committee which makes recommendations to the Board as appropriate.

As a Board we are responsible for overseeing the company’s arrangements for risk management, identifying key and emerging risks, considering risk appetite, and agreeing appropriate mitigation strategies. More detail on our risk management processes is included in Section 3 of the Strategic Report.

All decisions are taken with due regard to the company’s purpose and objectives (as set out in the Articles of Association and other relevant documents), the effective and efficient use of public funds and meeting our statutory obligations as an Appointing Person.

(b) The interests of the company’s employees

We aim to be a good employer, encouraging a culture of openness and transparency, developing people to the best of their abilities and offering competitive remuneration and benefits to recruit and retain staff. The Board recognises that a team of well qualified staff is critical to the success of PSAA. To this end, the Board monitors the organisational work streams and capacity via regular updates from the Chief Executive.

As a result of the pandemic, staff have been required to work remotely since March 2020. We have recognised the importance of supporting our workforce during these difficult times and have put in place a number of measures to ensure that staff are able to work effectively and remain connected whilst working remotely. This has included twice weekly team check-ins using virtual meeting technologies, regular manager contact, financial support to purchase office equipment, and access to the Employee Assistance Programme. We have also held well-being support sessions and regular virtual social events.

Given the challenges faced by the company and the local audit system more widely during the year, which has generated a significant amount of additional work, the Board recognised the need to enhance the existing structure with additional resource and skills. During 2020 we engaged a consultant to develop a work force plan alongside a review of capacity and anticipated workload. As a result of the recommendations from the review, capacity has been increased and specialist skills have been introduced in key areas such as procurement and communications. These appointments have been made through fixed term contracts. This provides an agile model which can be flexed to adapt to changing skills and capacity requirements as circumstances alter and whilst we await the implementation of the Government’s response to Redmond and other reviews.

During 2020/21 our focus has been on developing the team in their new roles. Personal Development Plans are in place to support individual staff needs as appropriate. Employees have access to the LGA e-learning platform (provided as part of the agreement with the LGA for back office support services) for training on a variety of topics including annual mandatory refreshed training on IT security and information governance. We are also supportive of individuals’ continuing professional development requirements.

With a small team, good communication is imperative. Board and audit committee papers are accessible to all staff. All employees are kept up to date with items considered at Board meetings and in relation to PSAA’s finances, and these are standing agenda discussion items at team meetings.

(c) The need to foster PSAA’s business relationships with suppliers, customers and others

Positive business relationships are recognised to be critical to the company’s success. Relationships with audit providers are of vital importance. Local audit requires sufficient capacity of specialist knowledge and expertise. Retaining existing suppliers and, if possible, encouraging new firms to enter the market will help to ensure that the market remains sustainable and competitive.

Close links and open communications with opted-in bodies will enable us to understand and better meet sector needs. The Board is also committed to building and maintaining strong, effective links with other organisations which perform specialist roles in the new local audit system so that the system as a whole operates efficiently and in a way that meets the needs of opted-in bodies and users of accounts.

The long-term success of PSAA is therefore critically dependent on the way we work with our customers, suppliers and other stakeholders.

Our customers

Our customers under the appointing person arrangements are opted-in local authorities, police and fire bodies. We operate on a not-for-profit basis, and any surpluses are returned to the opted-in bodies.

The views of our customers are very important to us and we aim to understand their priorities. We engage with our customers through a variety of different means:

- We have an Advisory Panel whose members represent the finance communities within different types of opted-in bodies. This forum provides helpful feedback and insights into all aspects of our policy making and has enabled PSAA to consult stakeholders and adopt approaches which work for opted-in bodies.

- We ensure that all stakeholders have sufficient information and time to enable them to respond effectively to our consultations, for example, in relation to fees and appointments. Additionally, relevant bodies are consulted in relation to any changes to our new auditor appointments in accordance with PSAA’s governance framework.

- Our Local Audit Quality Forum (LAQF) has been set up to support the role of audit committees of opted-in bodies in relation to audit quality. Our commitment to audit quality for opted-in bodies features strongly in our monitoring work. We believe that the forum provides a meeting place in which all of the parties that have a responsibility for audit quality can share experiences and good practice. In particular we aim to help local audit committees to play their critical and demanding roles effectively. During 2020 due to the pandemic, the LAQF moved to a webinar platform when we hosted an event with Sir Tony Redmond speaking about his report. The event attracted over 200 attendees. Due to the success of the LAQF on this platform, we will consider using this format for future events until such time as we can hold events in person again.

- With the LGA and CIPFA we have developed a leadership essentials training course specifically tailored to meet the needs of audit committee chairs. This training is provided to LGA member organisations.

- Annually we survey customers as part of our monitoring arrangements in respect of the quality of the services they are receiving. The results of the first survey in respect of the 2018/19 audits were reported in May 2020 and included within the 2019/20 Audit Quality Monitoring Report. The key messages were discussed with the audit firms. In recognition of the pressures on bodies due to the burden of responding to the pandemic, our 2020 survey (in respect of the 2019/20 audits) was condensed, and the results will be reported as part of our 2020/21 Annual Quality Monitoring Report.

- We have attended and presented at a number of local finance, audit and networking group events.

We have developed a communications strategy which identifies our key stakeholders and the channels of communication through which we engage with each group. We keep this under constant review as a pre-requisite for our continued success.

Our suppliers

Our main suppliers are the audit firms with whom we contract to provide audit services to our customers. The development of strong, long-term relationships with audit firms is not only critical for delivering quality audit services under the current contract but also for future sustainability of the local audit market.

The resourcing difficulties and other challenges which emerged during the course of the audits of the 2018/19 accounts which resulted in the target publishing date for publishing audited accounts by 31 July 2019 being missed in over 40% of audits (208 out of 486), has continued to be a problem for 2019/20 audits. The knock-on impact of the delayed 2018/19 audits combined with the impact of the pandemic have meant that even with a revised target deadline of 30 November 2020, 56% of audited accounts (264 out of 478) were not published by the target date. Staff recruitment and retention continues to be a major challenge in the current climate.

We are disappointed that these difficulties have arisen and recognise the importance of auditors meeting the target deadline set wherever possible and we are committed to working with other stakeholders to find solutions to ensure that the position improves as rapidly as possible.

As a result of the Redmond review published in September 2020, there is now a wider recognition and understanding of the underlying issues which have created a fragile local audit market. In March 2021 the NAO published their report on Timeliness of Local Auditor Reporting on Local Government in England, 2020. The report concluded that since the last review on local authority governance and audit in 2019, despite efforts by the various organisations involved in the local audit system and by MHCLG, the local audit system is exhibiting signs of increasing stress. The increase in late audit opinions, concerns about audit quality and doubts over audit firms’ willingness to continue to audit local authorities all highlight that the situation needs urgent attention.

We are very conscious of the disappointment of opted-in bodies whose audited accounts were not published by the target dates and of the disruptive impact on the work plans of those bodies of rescheduling their audits. We will continue to monitor the position and have discussed with the firms concerned their recovery plans to complete the audits as soon as possible. However, it is recognised that there are no quick or easy solutions to the developing issue of scarce auditor resource resulting in the need to implement effective long-term solutions.

During the year, the Chief Executive and on occasions the Chair met with audit suppliers both individually and as a group. This facilitates discussion of issues of common concern, and specifically these meetings have been used as a forum for discussions about audit resources.

To provide transparency and encourage best practice, we publish quality monitoring reports on PSAA’s website on the performance of our contracted firms and the quality of the audit services they deliver. Latest fee variation information is also included in our quarterly quality monitoring reports.

PSAA participates in the groups established to manage the implementation and delivery of the Local Audit and Accountability Act 2014 (LAAA 2014): The Ministry of Housing, Communities and Local Government (MHCLG) Local Audit Monitoring Board, its local audit sub-group and NAO’s Local Audit Advisory Group and the Forum for Local Audit Regulation in England (FLARE). These groups include representatives of the audit firms, the regulatory bodies and government departments.

PSAA staff carry out annual monitoring of each contracted firm addressing both financial health and significant threats to reputation which might be relevant to the firm’s contractual responsibilities to PSAA. The results of this work are reported to the Board by the Chief Executive.

Other key suppliers of services to the company are: the LGA which provides our back-office support services and accommodation; and CIPFA which provide technical reports and publications. PSAA staff meet regularly with these suppliers to ensure positive relationships and early resolution of any concerns.

Wherever feasible, we use the services of smaller suppliers to support the general day to day running of our business.

Other stakeholders

Given our unique position within the local audit environment, we work with a number of key stakeholders and regulators to ensure the quality of local audit services, and we are represented on various key fora.

Our other main stakeholders include MHCLG, the NAO, the FRC, ICAEW, and CIPFA. The Chair and the Chief Executive and/or officers attend meetings with the stakeholders as appropriate, with updates in the Chief Executive’s regular reports to the Board.

We contributed to the Redmond review providing a large volume of information and responding to questions. Following the publication of the Redmond review in September 2020 and MHCLG’s initial response in December 2020, we have been working with MHCLG by providing detailed briefings in relation to our work under the appointing person regime and our procurement processes.

We also engage with sector wide initiatives and contribute views and information for Government commissioned reviews and studies. We responded to the NAO’s consultation on their revised Code of Audit Practice for local audit and subsequently on the NAO’s supporting Auditor Guidance Notes (AGN03) which provide more detail on the auditor’s responsibilities under the new Code, with a view to securing positive outcomes for opted-in bodies and users of accounts. We also responded to the Public Audit Forum’s revised Statement of Recommended Practice – Practice Note 10: Audit of financial statements of public sector bodies in the UK.

We responded to MHCLG’s consultation on proposals to move the publishing deadlines for audited accounts for 2020/21 and 2021/22, and also its consultation on proposed changes to the Accounts and Audit Regulations.

We provided comments and detailed information relating to audit completions to the NAO for their review of the Timeliness of Local Auditor Reporting on Local Government in England 2020. The findings from this report were considered by the Public Accounts Committee, with Tony Crawley appearing before the PAC, responding to their questions over concerns about delays in audit completions, audit quality and doubts over audit firms’ willingness to continue to audit local public bodies.

The Committee has now published its report with the title “Local auditor reporting on local government in England” which can be found at: Public Accounts Committee – Reports, special reports and government responses – Committees – UK Parliament

In March 2021 the Department for Business, Energy and Industrial Strategy (BEIS) issued a consultation on a package of measures aimed at improving the UK’s audit, corporate reporting and corporate governance systems arising from the three independent reports produced by Kingman, CMA and Brydon. We have responded and highlighted the potential impact of these recommendations for the local audit sector.

(d) The impact of the company’s operations on the community and the environment

The Board regards local audit as an important cornerstone of local accountability. PSAA’s most significant contribution to the community therefore lies in its responsibility to ensure that affordable audits which meet quality standards continue to be delivered to each and every opted-in body by competent suppliers.

The LGA provides a range of support services to the company, including provision of serviced accommodation, HR, ICT and payroll support. This agreement was reviewed and renewed for a three-year period commencing in April 2021. As well as operating efficiencies and economies of scale, this arrangement enables PSAA to subscribe to and participate in a range of LGA policies and initiatives. These include flexible/home working, an office recycling scheme, and use of energy efficient office equipment.

PSAA is wholly owned by the Improvement and Development Agency (IDeA) and we have embraced its environmental policy, which includes a commitment to reduce our environmental footprint by:

- continually reducing waste and increasing recycling rate;

- reducing paper use;

- ensuring that procurement of goods and services adheres to the green purchasing and procurement policy; and

- complying with all applicable legislation, regulation and other relevant requirements relating to our environmental impacts.

Due to the measures put in place in response to the pandemic, since March 2020 our staff have been required to work remotely, removing the need to utilise office-based environmental schemes. However, there are significant benefits on the environmental impact of remote working. When we do return to the office, we will review our flexible working policy and will consider our environmental impact as part of this review.

Our appointing person procurement scheme required suppliers to identify the social value benefits which would accrue from any contract award. This secured commitments to apprenticeships, training and other arrangements which are included in firms’ method statements. Our on-going monitoring of the contract reviews performance against this commitment. Across our five firms over 400 positions were to be provided across the life of the contract with 90 in place in the first year. Initial information shows that 137 apprenticeship and other training positions were introduced in the first year of the contract.

Customers and their local communities will benefit from the value for money achieved from our procurement exercise and the reimbursement of surplus fees.

Our staff complete mandatory e-learning training modules on dignity at work and equality in the workplace. The Board annually approves a statement on modern slavery which is published on the website and staff complete annual on-line training.

(e) The desirability of PSAA maintaining a reputation for high standards of business conduct

High standards of corporate governance are a key factor in underpinning the integrity and efficiency of PSAA. We believe that they are critical in helping us to achieve our core objectives as set out in our Articles of Association. Our arrangements draw on a number of good practice sources including the principles set out in the Code of Conduct for Board Members of Public Bodies (issued by the Cabinet Office) and in the UK Corporate Governance Code, to the extent that the latter can be applied to a small company without shareholders. We review our corporate governance framework annually to ensure it remains fit for purpose and publish full details on our website.

Board recruitment

Our Chairman is appointed by the IDeA and other non-executive Directors are, with support from Whitehall Industry Group and an interview panel of other Board members, appointed by the Chairman. The composition of the Board is intended to bring together a range of skills and experience relevant to the governance of the company and its distinctive role and sphere of business.

In January 2021 the IDeA Board approved a Board succession plan for PSAA based upon a rotational retirement and replacement of directors in order to preserve skills and experience whilst providing the opportunity to refresh Board membership.

Our staff

The company’s structure is designed to ensure PSAA is fit for purpose to fulfil the company’s appointing person responsibilities. The roles in the organisational structure are filled by employees with the necessary skills, qualifications and experience. Most PSAA staff are members of professional accountancy bodies. We encourage and fund staff to attend training and maintain continuing professional development (CPD).

Our stakeholders

We aim to be as transparent as possible about our business, finances, statutory responsibilities and governance including making information available in accordance with the Local Government Transparency Code. From April 2019 PSAA has been subject to the requirements of the Freedom of Information Act. We have developed a policy and staff procedures to ensure that we are compliant with such requirements. PSAA’s publication scheme is available on our website and provides detailed information about the company and its functions.

Corporate Governance framework

PSAA has established a robust corporate governance framework which is reviewed annually. Further details are included in Section 3 of the Strategic Report on Risk Management and within the Governance Report.

The Board is committed to continuing to assess and review its performance and arrangements in relation to the framework now that we have transitioned from a regulatory body exercising powers delegated by the Secretary of State to an organisation operating as a specified appointing person under the Local Audit and Accountability Act 2014.

2. Business review

In our sixth full year of business, covered by this report, the company has focused on embedding the arrangements to discharge its appointing person responsibilities against a backdrop of increasing turbulence in the local audit sector which has been exacerbated by the pandemic.

Auditor appointments

Appointments made for the five years of the appointing period cover audits of the accounts of opted-in bodies for the period 2018/19 to 2022/23. Auditor appointments began with effect from 1 April 2018. In order to be eligible for our contracts, firms had to be approved by a relevant recognised supervisory body. Five such suppliers were contracted to provide audit services to opted-in bodies.

| Lot | Firm | PSAA market share |

| 1 | Grant Thornton UK LLP | 40% |

| 2 | Ernst and Young LLP | 30% |

| 3 | Mazars LLP | 18% |

| 4 | BDO LLP | 6% |

| 5 | Deloitte LLP | 6% |

At 31 March 2020 there were 487 local government bodies eligible to opt into the PSAA scheme, 478 (98%) of which had opted in. This high level of support from eligible bodies has enabled us to offer a scheme which maximises benefits and provides excellent value for money for participating bodies.

There are small changes every year in the number of bodies eligible to opt in as a result of local government reorganisations or the establishment of new bodies. A full list of opted-in bodies is maintained on our website in accordance with the Local Audit (Appointing Person) Regulations 2015.

Setting audit fees

PSAA’s statutory appointing person responsibilities include specifying a scale or scales of fees for the audit of accounts of opted-in bodies. The regulations require PSAA to set the fee scale before the start of the financial year to which the fees relate. The fee scale cannot be amended once the relevant financial year has started.

A significant proportion of audit work is undertaken after the close of the relevant financial year by necessity. Setting the fee scale in advance of the start of that year, as the regulations explicitly require, therefore presents significant challenges when audit is subject to as much change as it is currently. Ideally, we would be able to set fees with the benefit of relatively complete information about all preceding years’ audits. In practice, we had to consult on 2021/22 fees with incomplete information in relation to:

- audits of 2018/19 accounts, for which a minority of audit opinions remained outstanding;

- audits of 2019/20 accounts (a significant proportion of opinions remained outstanding); and

- audits of 2020/21 accounts (very limited if any audit work done at the time the fee scale was set).

Our position is therefore in essence comparable to a local body being required to set its budget with incomplete information about spending and revenues in preceding years, and with minimal information about the immediate prior year.

The regulations allow PSAA to consider requests for additional audit fees from audit firms where substantially more work is needed than was envisaged when the firms bid and the fee scale was set. Such requests can only be considered once the audit is complete and are managed under PSAA’s fee variations process. Fee variation requests have been increasing in volume and value in response to greater regulatory scrutiny of auditors’ work and changes in audit requirements such as revised auditing and accounting standards and the new Code of Audit Practice.

In setting the 2021/22 fee scale PSAA included additional fees approved for 2018/19 audits that relate to ongoing requirements that will apply in future audit years. While the impact of changes in audit requirements varies depending on the local circumstances of individual opted-in bodies, the overall trend is that additional audit fees are increasingly required across all opted-in bodies for auditors to discharge their statutory responsibilities. A high level of fee variations is expected for 2019/20 audits, and as these were not yet fully known they could not be included in the 2021/22 fee scale.

PSAA consulted in November 2020 on changes to fee variations arrangements with the aim of reducing, if possible, the volume of local discussions about fee variations. We proposed a new approach to allow for national variations, where changes in audit requirements relate to the conduct of all or most audits and where a standard cost can reasonably be estimated across groupings of bodies. The consultation also set out a proposed increase in the fee rates for additional work.

On the basis of the response to the consultation, PSAA resolved to implement the proposed changes and has taken the following steps:

- a programme of research is under way to consider the likely impact on audit work and fees of some expected changes in audit requirements;

- subject to MHCLG updating the regulations, the new approach to national variations could apply for the first time in relation to audits of 2020/21 financial statements and value for money arrangements where appropriate topics are identified; and

- all variations – both national and local – arising in relation to audits of 2020/21 financial statements and value for money arrangements onwards will be calculated in accordance with a new rate card reflecting increased hourly rates for different categories of audit staff.

Helpfully, the Government’s policy response to the Redmond Review has included a commitment to review the Appointing Person regulations. We have worked with MHCLG on their consultation to reform the regulations. We hope the outcome of the consultation will be to provide the appointing person with greater flexibility to ensure the recurring costs to audit firms of additional work are built into scale fees in a more timely, flexible and seamless way. MHCLG has committed to having new regulations in place before the summer recess 2021, and has announced the intention to provide additional one-off funding of £15 million in 2021 in relation to increased audit costs.

The challenges facing the local audit environment are such that they do not lend themselves to immediate or easy solutions. Nevertheless, PSAA is continuing to work closely with stakeholders to develop solutions and help to build a more resilient sustainable system.

Contract monitoring arrangements

We have robust contract monitoring arrangements in place to manage the contracts with the audit firms, and to fulfil our appointing person role and responsibilities. Ongoing contract management arrangements have the dual purpose of reporting results to opted-in bodies and ensuring that PSAA meets its obligations under the Local Audit (Appointing Person) Regulations 2015 to monitor compliance of auditors against the requirements in the audit contracts.

We oversee issues of the independence of our appointed auditors. This includes reviewing requests to provide non-audit consultancy services and monitoring the rotation of audit staff to minimize the threat from long association.

We have a complaints process covering the carrying out of audit work by the auditors we have appointed, but not the judgements they have independently reached.

We also monitor compliance by local auditor against the contractual obligations in our contract. This is principally covered in our processes looking at the quality of audit services provided. These include compliance with our Terms of Appointment which clarify the standards for performing the services under the contracts and provide a reference for matters of practice and procedure which are of a recurring nature.

Quality of audit services

One element of our contract monitoring framework is to monitor the quality of audit services.

We have adopted the International Auditing and Assurance Standards Board’s Framework for Audit Quality (the IAASB framework) as the model for the appointing person quality of audit services monitoring arrangements. Audit quality formed a core part of the evaluation of tenderers in the 2017 audit services procurement, with tenderers also encouraged to have regard to the IAASB framework in their responses.

Our approach is based on the expectation that good quality audit services are likely to be achieved by an engagement team that:

- exhibits appropriate values, ethics and attitudes;

- is sufficiently knowledgeable, skilled and experienced and has sufficient time allocated to perform the audit work;

- applies a rigorous audit process and quality control procedures that comply with law, regulation and applicable standards;

- provides useful and timely reports; and

- interacts appropriately with relevant stakeholders.

While responsibility for the quality of an audit rests ultimately with the auditor, audit quality, efficiency and effectiveness are shared responsibilities. The IAASB framework notes that all parts of the financial reporting supply chain (including audit firms, regulators, standard setters and audit committees) have a role in contributing to and encouraging an audit environment that supports audits which meet quality standards. There is a complex interplay of many factors. We have taken the attributes that the IAASB Framework expects to be present within an audit and distilled them into three key tests:

- adherence to professional standards and guidance, obtained from the results of professional regulatory reviews;

- compliance with contractual requirements, obtained from monitoring; and

- relationship management obtained from client satisfaction surveys.

We commissioned the LGA Research Team to conduct a survey to obtain opted-in bodies’ feedback on their audits of 2018/19 accounts. The survey arrangements are an important strand of our Quality Monitoring and Reporting Framework and the survey responses have provided us with the opportunity to identify good practice and discuss specific areas for improvement with individual audit firms.

Overall, the survey results showed that 80% of respondents were content with the quality of the audit service provided, but the known tensions in the local audit world around resourcing and property and pension valuations were highlighted. The nature of the survey meant that it was difficult to draw meaningful comparisons between firms but there is work to be done by all to achieve improvements. Together with the other elements of our monitoring the survey results provide a strong evidence base from which firms will be able to develop tailored improvement plans where appropriate.

We reduced the number and detail of our questions this year (covering 2019/20 engagements) recognising the many calls on local authority staff whilst still obtaining the core information that we require.

Our first 2020 Audit Quality Monitoring Review covering the 2018/19 audit engagements was published in February 2021. This was later than planned because of pandemic induced delays for the Financial Reporting Council and Institute of Chartered Accountants in England and Wales in completing and reporting on their professional regulatory reviews.

We have continued to pay close attention to the results of audit inspections carried out by the FRC and the ICAEW and to discuss any key issues arising with suppliers.

Transitional arrangements

PSAA has been responsible since 1 April 2015 for specific functions delegated to it on a transitional basis by the then Secretary of State for Communities and Local Government. These responsibilities included appointing auditors and setting fees for principal local government and NHS bodies, making arrangements for housing benefits subsidy claim certification, and managing contracts novated to PSAA on the closure of the Audit Commission in March 2015. In December 2020 the Secretary of State extended these transitional powers for a further three years to 31 December 2023.

The outstanding elements of this work relate mainly to the 2017/18 audits of local government bodies. As at March 2021 this work is still on-going at four authorities where there are conclusions outstanding. There are 20 objections being investigated. There are also two small authority bodies where certificates and opinions have not been issued.

3. Risk Management

Risk management arrangements

The objectives of PSAA’s risk management arrangements are to:

- maintain a risk management framework which provides assurance to the Board that strategic and operational risks are being managed effectively to ensure that objectives can be achieved;

- ensure that risk management is an integral part of PSAA’s culture and operations;

- contribute to making informed decisions and effective resource planning; and

- inspire trust and confidence amongst our key stakeholders.

In relation to risk management, the Board is responsible for taking a balanced view of the company’s approach to managing opportunity and risk. The Board’s responsibility includes:

- ensuring that effective arrangements are in place to provide assurance on risk management, governance and internal control;

- ensuring that the risks it faces are dealt with in an appropriate manner, in accordance with relevant aspects of best practice in corporate governance; and

- approving the risk management strategy and setting the risk appetite.

As a company responsible for handling public money, PSAA’s tolerance of risk is generally low.

In October 2020 the risk management strategy was reviewed and updated to reflect changes to the approach which underpins our risk strategy – ‘HM Treasury Orange Book: Management of Risk – Principles and Concepts’.

The PSAA audit committee is responsible for reviewing and challenging the company’s assessment and management of risk and the adequacy of internal controls established to manage strategic and operational risks identified. The audit committee scrutinises the corporate risk register at each meeting and may ask for further reports or presentations on specific risks as it considers necessary. The chair of the audit committee reports to the Board at each meeting on risk management.

The Chief Executive is responsible for maintaining the company’s system of internal control and assurance framework, providing the Board and audit committee with assurance on the system’s ongoing effectiveness and appropriateness, and advising the Board and audit committee as to material changes.

The PSAA team reviews the corporate risk register on a regular basis and specific members of the management team are responsible for managing the individual risks. The team review each of the risks to ensure that the actions identified are up to date/remain appropriate and considers whether there are any new risks that should be added to the risk register.

Current risks

During the year PSAA has monitored the potential risks to the company being able to achieve its objectives and has put in place mitigating actions wherever possible. Many of the risks to PSAA’s objectives arise from the turbulence in the local audit sector and market sustainability, which are factors outside our control.

The significant risks facing PSAA in achieving its business objectives are that:

- Audit firms’ risk/reward assessments of the local audit opportunities conclude that the market is insufficiently attractive leading to a reduction in the number of active suppliers and posing a threat to the competitiveness of the market and its ability to meet the sector’s needs;

- An audit supplier does not meet PSAA’s contractual requirements in terms of delivery and/or quality of audit services; and

- PSAA’s scheme and the local audit framework is impacted by the Government’s responses to the reviews of the wider audit profession and local audit framework.

These risks have the potential to impair PSAA’s ability to deliver its functions efficiently and effectively. The audit committee and the Board are sighted in relation to these risks and regularly monitor the arrangements in place to manage them, although recognising that there are significant market factors which are outside of PSAA’s direct control. Where this is the case PSAA actively seeks to work with other stakeholders to influence a sector wide response to the management of risk.

Future risks

Longer term there are a number of wider challenges which have the potential to impact on local audit, opted-in bodies and PSAA. These include:

- possible changes in audit regulation, auditing standards and audit firms;

- the challenge of ensuring that the local audit system as a whole works effectively and meets the needs of opted-in bodies and users of accounts;

- the need to maintain a sustainable, competitive local audit market; and

- the related challenge to ensure an adequate supply of suitably qualified and experienced audit staff.

The Redmond Review has helped to raise the profile of these issues. PSAA continues to commission research and to work closely with other stakeholders to explore options to address these important challenges.

4. Financial review

Being financially responsible

PSAA is committed to securing value for money, ensuring it delivers its objectives while minimising costs. PSAA strives to be financially responsible by:

- exercising financial discipline and maintaining a robust control environment;

- keeping running costs to a minimum;

- returning surplus funds to opted-in bodies;

- ensuring the company’s internal auditors review the internal control environment annually to provide assurance on the financial controls and confirm these are working as intended;

- meeting the company’s statutory obligations; and

- meeting PSAA’s duties as a good employer.

The company’s internal auditors, TIAA Limited, have reported substantial assurance for payroll, purchase orders and invoices, treasury management and information governance arrangements. In respect of data security, the audit assurance was reasonable, flagging up the need for us to obtain appropriate assurances over control arrangements from our IT services provider, the LGA. We have now taken the relevant steps to address this recommendation.

Turnover and profit on ordinary activities

The revenue received by PSAA must cover the costs of paying auditors for work under the audit contracts and the operating expenses of PSAA.

PSAA’s accounts show a £nil profit for the 12 months to 31 March 2021 as revenue is matched to expenditure and any monies not required to cover costs are returned to opted-in bodies at appropriate intervals.

Revenue, including investment income, for the 12 months to 31 March 2021 was £30.535 million (2019/20 £26.304 million) which covered the costs including corporation tax incurred by PSAA for the period 1 April 2020 to 31 March 2021 of £30.535 million (2019/20 £26.304 million). The increase in revenue and associated audit costs are mainly due to higher levels of fee variations expected for audit year 2019/20 (our current projection is 40% of scale fees) compared to previous audit years (the fee variation rate for audit year 2018/19 is 15% of scale fees). Requests have been increasing in volume and value and we expect firms to submit fee variations for every audit, mainly in response to greater regulatory scrutiny of auditors’ work, property, plant and equipment valuations, pension valuations and COVID related costs. We have reviewed and updated our revenue recognition policy to include the treatment of fee variations. The decrease in investment income reflects the significantly lower interest rates available in the market.

Controlling costs

PSAA incurred total costs of £30.535 million, of which the cost of the audit contracts for the period was £29.240 million, 95.8% of total costs (2019/20: £25.217 million which represented 95.9%).

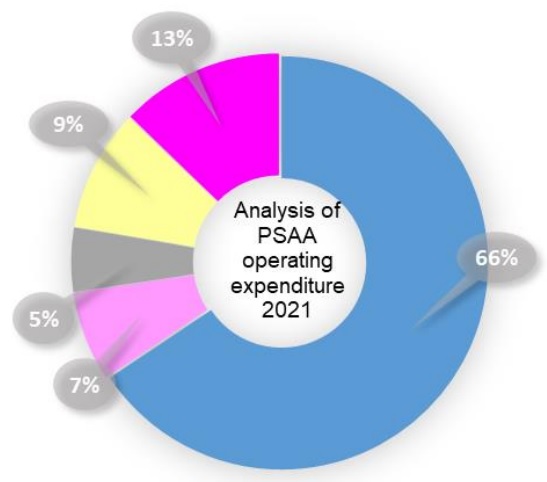

The chart shows the split of PSAA incurred operating expenses of £1.293 million in 2020/21. This represents 4.2% of total costs (2019/20: £1.077 million which represented 4.1% of total costs) and taxation of £0.002 million (2019/20: £0.010 million).

Financial position

PSAA’s total assets equal total liabilities at the end of 31 March 2021 (31 March 2020: total assets also equalled total liabilities). PSAA is required to pay any surplus funds to principal opted-in bodies, as provided for in its Articles of Association. Surplus funds are shown as a liability in the balance sheet as part of deferred income. The deferred income is regularly reviewed to ensure PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. Funds no longer required are returned once approved by the Board. At 31 March 2021 the surplus funds remaining were £7.708 million. The Board plans to distribute in the region of £5.600m to opted-in bodies in financial year ending 2021/22. It is expected to leave approximately £2.108million in the long term deferred income.

Future developments

The financial year 2021/22 will be yet another significant one for local audit and PSAA with a number of key changes on the horizon:

- In March 2021 the government published a White Paper setting out its plans to reform corporate audit, reporting and governance, based upon recommendations arising in the reviews of the audit sector (Kingman, Brydon and the Competitions and Market Authority). The government proposes to establish a new regulator, the Audit, Reporting and Governance Authority (ARGA) to replace the FRC. The government is considering the responses and will make decisions on implementation. These reviews are expected to impact audits of all types of entity and will therefore have implications for local audit. We will monitor any developments for their potential impact on local audit, the company, opted-in bodies and contracted audit suppliers.

- In December 2020 MHCLG delivered its response to the Redmond Review setting out proposed actions to implement the majority of the recommendations made in the report. This was followed by a further announcement in May 2021 which responded to the options for systems leadership and confirmed that PSAA will continue as the appointing body for local audit.

- Redmond recommended that the current fee structure for local audit be revised to ensure that adequate resources are deployed to meet the full extent of local audit requirements. In response, MHCLG have consulted on proposals to make amendments to the Local Audit (Appointing Person) Regulations 2015 that will, subject to stakeholders’ views, provide PSAA with more flexibility to agree additional fees more quickly and at the time that the relevant audit work is completed, as opposed to after the completion of the audit.

- The national appointing person scheme formally commenced in April 2018. The duration of the first appointing period was set at five years and so will run until 31 March 2023. The second appointing period will commence on 1 April 2023. Preparations are underway for the next opt-in arrangements and development of our procurement strategy. This will be an area of significant focus and activity during 2021/22.

- The revised Code of Audit Practice is applicable for accounting periods from 2020/21 going forward. We are working to quantify the impact on the associated fee scale for the remaining three years of the appointing period.

- We will monitor the implications of the COVID-19 pandemic on the delivery of audits and signing of audit opinions within the revised target timetable set by MHCLG.

By order of the Board

Steve Freer

Chairman

23 July 2021