Strategic report

The directors present their strategic report for the year ended 31 March 2023.

1. Objectives and operating environment

PSAA’s responsibilities and aims are expressed through a series of objectives, set out in our Articles of Association, covering the following areas of activity:

- appointing auditors to relevant authorities;

- consulting on and setting a scale or scales of fees, and charging fees, for the audit of accounts of relevant authorities;

- ensuring that public money from audit fees continues to be accounted for properly and is protected;

- overseeing the delivery of consistent, high quality and effective audit services to relevant authorities;

- ensuring effective management of contracts with firms for audit services to relevant authorities;

- being financially responsible having regard to the efficiency of operating costs and transparently safeguarding fees charged to opted-in bodies; and

- leading our people as a good employer.

During 2023 we hope to agree a new memorandum of understanding (MoU) with key partners including DLUHC and the LGA setting out the broad framework within which PSAA operates. A similar MoU was agreed in 2015 but now needs to be updated and refreshed.

The Board believes that strong and effective corporate governance supports the future long-term success of PSAA. It has in place, and regularly reviews and updates, a comprehensive governance framework to support the company’s functions as an appointing person.

2. Business review

In our eighth full year of business, covered by this report, PSAA has focused on discharging its appointing person responsibilities against a backdrop of increasing turbulence in the local audit sector. The procurement for audit services contracts for the second appointing period commencing in April 2023 has been a particular focus this year.

2018/19 to 2022/23 auditor appointments

Appointments made for the five years of the first appointing period cover audits of the accounts for the period 2018/19 to 2022/23. In order to be eligible for our contracts, legislation requires firms to be registered by a relevant recognised supervisory body.

The five suppliers contracted to provide audit services to opted-in bodies for this period are set out below:

| Lot | Firm | PSAA market share 2018/19-2022/23 |

| 1 | Grant Thornton UK LLP | 40% |

| 2 | Ernst and Young LLP | 30% |

| 3 | Mazars LLP | 18% |

| 4 | BDO LLP | 6% |

| 5 | Deloitte LLP | 6% |

At 1 April 2022 there were 476 local government bodies eligible to be members of the PSAA scheme, 467 (98%) of which had opted in. This high level of support from eligible bodies has enabled us to offer a scheme that strives to maximise benefits and value for money for participating bodies.

There are small changes every year in the number of eligible bodies, as a result of local government reorganisations or the establishment of new bodies. A full list of opted-in bodies is maintained on our website in accordance with the regulations. List of auditor appointments and scale fees – PSAA.

Timeliness of audit completion

The resourcing difficulties and other challenges which first emerged during the course of the audits of the 2018/19 accounts have continued to be a significant and escalating problem during subsequent years. The result is that at 31 March 2023 545 opinions are delayed, as summarised in the table below.

| Audit year Publishing date | Number of opted in bodies | Percentage of audits complete by publishing date | Number of audits outstanding at 31 March 2023 |

| 2021/22 – 30 Nov | 467 | 12% | 347 |

| 2020/21 – 30 Sep | 474 | 9% | 145 |

| 2019/20 – 30 Nov | 478 | 45% | 39 |

| 2018/19 – 31 Jul | 486 | 57% | 10 |

| 2017/18 – 31 Jul | 494 | 87% | 2 |

| 2016/17 – 30 Sep | 497 | 95% | 1 |

| 2015/16 – 30 Sep | 497 | 97% | 1 |

We are concerned and disappointed that these difficulties have arisen and recognise the importance of auditors meeting target deadlines wherever possible. We are very conscious of the frustrations of opted-in bodies whose audited accounts were not published by the target dates and of the disruptive impact of delayed audits on the work plans of those bodies.

During 2021 the NAO reported on the timeliness of local auditor reporting in local government in England which was also the subject of a Public Accounts Committee (PAC) inquiry and a resultant report. Tony Crawley, PSAA’s Chief Executive, gave evidence to the Committee which subsequently published its report “Local auditor reporting on local government in England”. The report can be found at: Public Accounts Committee – Reports, special reports and government responses – Committees – UK Parliament.

The NAO published a follow up report in January 2023 (Progress update: Timeliness of local auditor reporting on local government in England – National Audit Office (NAO) report ) and a further PAC hearing took place in March 2023 to which Tony Crawley again gave evidence. The level of interest and concern demonstrated by both the NAO and the PAC is a reflection of the seriousness of the position and its potential implications for good governance, financial management and local accountability.

Audit services procurement for the second appointing period

In May 2021 the Secretary of State confirmed that PSAA would continue as an appointing person under the Act. Towards the end of 2020/21 PSAA began a significant programme of work to develop the national appointing person scheme for the second appointing period commencing in April 2023.

Eligible bodies were required to notify PSAA if they wished to join the national scheme by March 2022. We were delighted that over 99% of eligible bodies chose to opt in, with only 5 eligible bodies preferring to make local arrangements for their auditor appointments.

The total number of opted-in bodies from 2023/24 is 456 following local government reorganisation in three county areas. This includes one body who were unable to make a local appointment so asked the Secretary of State to intervene to enable PSAA to appoint their auditor.

Given the importance of the procurement for the next appointing period, we put in place formal project management arrangements to support good governance and manage risk. We also increased the frequency of Board meetings to enable careful and thorough consideration of strategic matters and timely decision-making.

The procurement initially secured 96.5% of the capacity required to enable auditor appointments to all opted-in bodies. We launched a rapid response supplementary procurement for all pre-qualified suppliers, from which we managed to achieve the further capacity required.

Based on the contracts awarded, from 2023/24 the respective shares of the audits of opted-in bodies will be as follows:

| Audit firm | Status of firm | PSAA market share 2023/24 – 2027/28 |

| Grant Thornton UK LLP | Existing | 36.0% |

| Mazars LLP | Existing | 22.5% |

| Ernst & Young LLP | Existing | 20.0% |

| KPMG LLP | Returning | 14.0% |

| Bishop Fleming | New | 3.75% |

| Azets Audit Services | New | 3.25% |

Average bid prices received in this procurement were a significant increase compared to our previous procurement in 2017, as a reflection of current market conditions.

We have communicated that bodies should anticipate a major re-set of fees for 2023/24 involving an increase of the order of 150% on the 2022/23 scale fees.

Following the completion of our main audit services procurement, we undertook a significant exercise to develop proposed auditor appointments. We consulted opted-in bodies on the proposed appointments, providing the opportunity to make representations about our proposals. The Board approved the final appointments in December 2022, following which all bodies were formally notified of their confirmed appointment.

Alongside the main audit services procurement, we undertook a procurement to establish a dynamic purchasing system (DPS). The establishment of a DPS has the potential to offer several benefits including providing an alternative source when new appointments are required. It will enable suppliers without a main audit services contract to bid for our work and provide greater flexibility in our approach to future procurements. Registered suppliers may apply to join the DPS at any point.

At the time of writing we are working with DLUHC as they consider and evaluate the different options for both the future commissioning and delivery of audit services.

Setting audit fees

PSAA’s statutory appointing person responsibilities include specifying a scale or scales of fees for the audit of accounts of opted-in bodies. The local audit regulations applicable from February 2022 require PSAA to consult on and set the fee scale before 1 December of the financial year to which the fee scale relates. The fee scale cannot be amended once it has been set.

PSAA consulted on and set the 2022/23 fee scale during 2022. Our fee strategy focused on adjusting the fee scale to reflect recurring changes in requirements, removing the need for discussion between audited bodies and auditors each year about additional fees for ongoing work. We have received generally positive feedback on this approach from opted-in bodies and stakeholders in previous consultations. Our consultation for the 2022/23 fee scale therefore set out a proposal, which was subsequently confirmed, to construct scale audit fees using the following elements:

| 2022/23 fee scale elements |

|---|

| A – The fee scale set for 2021/22 Plus: B – Fee variations for recurrent requirements in 2019/20 audits C – Fee variations for recurrent requirements in 2020/21 audits D – An adjustment of 5.2% for inflation required under our audit contracts, to be funded from the surplus which would otherwise be distributed to opted-in bodies (see table below for a worked example) Additional fees needed for work relating to additional changes in auditing and financial reporting requirements and to the VFM arrangements commentary to be determined using the fee variations process in 2022/23 audits and considered for consolidation into a future fee scale. |

A significant proportion of audit work is undertaken after the close of the relevant financial year by necessity. Setting the fee scale in advance of the start of that year therefore presents significant challenges when audit is subject to as much change as it is currently. Ideally, we would be able to set fees with the benefit of relatively complete information about all preceding years’ audits. In practice, we have to consult before the audits of the preceding year, and currently in many cases more than one year, are complete. For the 2022/23 fee scale, set during 2022, we did not have:

- information on any completed 2021/22 audits;

- complete information on all 2020/21 audits; and

- information for earlier years where there had been significant delays in audit completion.

The challenges facing the local audit environment are such that they do not lend themselves to immediate or easy resolution. PSAA is continuing to work closely with stakeholders to develop solutions and help to build a more resilient and sustainable system.

Fee variations

Fee variations are the mechanism by which PSAA approves additional audit fees. Additional fees are required when an auditor needs to undertake substantially more work than was envisaged when the fee scale for the audit was set by PSAA. This is an increasingly common occurrence in the current climate, which is very different from the previously relatively stable conditions for local audit before 2018.

Since PSAA’s current contracts with audit suppliers were let in 2017, audits have been subject to increased scrutiny and regulatory pressures as outlined earlier. Additional work has been required at most audits to enable a safe audit opinion on the financial statements in accordance with rising regulatory requirements. Further changes in audit requirements including the requirement for a VFM arrangements commentary in the Code of Audit Practice 2020 and some updated auditing and accounting standards have also placed pressures on auditors’ work and fees.

Auditors are obliged to have local discussions with individual opted-in bodies about any proposed fee variations. These discussions should take place at the earliest opportunity, and wherever possible the auditors should highlight at the planning stage any additional work which is likely to be required during the audit, including potential fee implications. While it may not be possible to quantify the proposed fee until the work is complete, early discussion can help to align expectations and avoid misunderstandings at a later stage. Where fee variations relate to ongoing audit requirements, PSAA aims to build the approved variations into scale fees at the earliest opportunity. As outlined in the previous section, this was a key element in our approach to setting the fee scale for 2022/23.

The table below sets out the expected number of fee variations (as at 31 March 2023) in respect of each of the relevant financial years. Projected numbers are based on the scope of the audit set out in the 2020 NAO Code of Audit Practice and may be subject to change as a result of measures to address the audit backlog.

Number of fee variations

| Audit year | 2018/19 actual | 2019/20 expected | 2020/21 expected | 2021/22 expected |

| Number of FVs submitted | 1,040 | 3,500 | 4,000 | 4,000 |

| % Change compared to 2018/19 | 237% | 285% | 285% |

Contract monitoring arrangements

Our contract monitoring arrangements reflect our statutory requirement under the Regulations to monitor firms’ performance in relation to the requirements of PSAA’s contracts and enable us to report the results of auditors’ work to audited bodies and other stakeholders.

We oversee any issues relating to the independence of our appointed auditors. This includes reviewing requests to provide non-audit consultancy services and monitoring the rotation of audit staff to minimise the threat of familiarity arising from long association.

We have a complaints process covering the audit work of our audit suppliers. However, this does not cover the judgements auditors have reached independently. We have a Memorandum of Understanding with the ICAEW and FRC to clarify arrangements and responsibilities for the review of such complaints.

Quality of audit services

We are very aware that quality of audit service delivery is a high priority for our opted-in bodies. Working within the boundaries of our remit in the local audit system and the limitations of the local audit market, we endeavour to secure quality audit services through our contracts with suppliers.

We use the International Auditing and Assurance Standards Board’s Framework for Audit Quality (the IAASB framework) as the model for monitoring the quality of audit services provided by our suppliers. This sets out the expectations for the provision of a good quality audit service which we have distilled into three key tests:

- adherence to professional standards and guidance, obtained from the results of professional regulatory reviews;

- compliance with contractual requirements, obtained from monitoring; and

- relationship management, obtained from our annual client surveys.

We publish quarterly reports on our website to help opted-in bodies understand how we are monitoring the performance of audit firms on their behalf and include other information as it becomes available, for example the results of our client surveys.

The results of our monitoring are published annually in our summary Audit Quality Monitoring Review, incorporating the results of the latest professional regulatory reviews undertaken by the FRC and ICAEW. Our latest annual review (Audit Quality Monitoring Report 2020/21 – PSAA) was published in March 2023.

We have a continuous dialogue with our contracted firms through regular meetings which consider specific matters raised by either party, provide feedback information about performance and quality and discuss any actions necessary to achieve specific improvements.

Transitional arrangements

PSAA has been responsible since 1 April 2015 for specific functions delegated to it on a transitional basis by the then Secretary of State for Communities and Local Government. These responsibilities included appointing auditors and setting fees for principal local government and NHS bodies, making arrangements for housing benefit subsidy claim certification, and managing contracts novated to PSAA on the closure of the Audit Commission in March 2015. In December 2020 the Secretary of State extended these transitional powers for a further three years to 31 December 2023.

The outstanding elements of this work relate mainly to the 2017/18 audits of local government bodies. At 31 March 2023 audit closure certificates had not been issued at 15 principal authorities as a result of ongoing audit work on financial statements (two authorities), or outstanding electors’ objections, or where other investigative work has to be concluded. There also remains one small authority where the certificate and opinion has not been issued.

3. Risk Management

Risk management arrangements

PSAA has in place a risk management framework which:

- provides assurance to the Board that strategic and operational risks are being managed effectively to ensure that objectives can be achieved;

- ensures that risk management is an integral part of PSAA’s culture and operations;

- contributes to making informed decisions and effective resource planning; and

- inspires trust and confidence with our key stakeholders.

The Board is responsible for taking a balanced view of the company’s approach to managing opportunity and risk. The Board’s responsibilities include:

- ensuring that effective arrangements are in place to provide assurance on risk management, governance and internal control;

- ensuring that the risks faced are dealt with in an appropriate manner, in accordance with relevant aspects of best practice in corporate governance; and

- approving the risk management strategy and setting the risk appetite.

As a company responsible for handling public money, PSAA’s tolerance of risk is generally low.

The audit committee is responsible for reviewing and challenging the company’s assessment and management of risk and the adequacy of the internal controls established to manage strategic and operational risks. The committee scrutinises the corporate risk register at each meeting and on occasion asks for further reports or presentations on specific risks as it considers necessary. The committee chair reports to the Board at each meeting on risk management.

The Chief Executive is responsible for maintaining the company’s system of internal control and assurance, providing the Board and audit committee with assurance on its ongoing effectiveness and appropriateness, and advising on any material changes.

The PSAA team reviews the corporate risk register on a regular basis and specific members of the management team are responsible for managing individual risks. The review includes identification of appropriate mitigations and consideration of any new risks that should be added to the risk register.

A project risk register was established to consider the specific risks associated with the procurement for the 2022 audit services contracts. This was reviewed regularly by both the Board and audit committee. In January 2023 at the conclusion of the procurement, the residual risks were subsumed within the corporate risk register.

Current risks

During the year PSAA has monitored the potential risks to achievement of our objectives including delivering on the procurement. Mitigating actions were put in place wherever possible.

The significant risks currently facing PSAA are that:

- an audit supplier does not meet PSAA’s contractual requirements in terms of audit quality and delivery and fails to deliver audits on a timely basis;

- a protracted period of inertia and uncertainty in the audit world impacts on PSAA’s scheme and reputation, and the wider local audit framework; and

- the volume of delayed audit opinions becomes unmanageably high, adversely impacting the governance, financial management and accountability systems of local bodies.

We recognise that many of the risks to the company achieving its objectives arise from the turbulence in the local audit sector and market which are, to a large extent, factors beyond our control. However, wherever possible we have sought to raise with system stakeholders the risks to the sustainability of the local audit sector and emerging issues, in order to influence the sector-wide response to risk.

Future risks

Over the next few years there will be a number of wider challenges and further change within the local audit system, which have the potential to impact on local audit, opted-in bodies and PSAA. These include:

- possible changes in audit regulation, auditing standards and audit firms;

- following the creation of ARGA as the system leader, addressing the challenge of ensuring that the local audit system as a whole works effectively and meets the needs of audited bodies and users of accounts;

- the need to maintain a sustainable, competitive local audit market; and

- the related challenge to ensure an adequate supply of suitably qualified and experienced audit staff.

In February 2023 the Board considered the potential implications of a number of scenarios which could arise and reflected the discussion points in the corporate risk register.

4. Financial review

Being financially responsible

PSAA is committed to securing value for money, ensuring it delivers its objectives while minimising costs. PSAA is a not-for-profit organisation and strives to be financially responsible by:

- exercising financial discipline and maintaining a robust control environment;

- keeping running costs to a minimum;

- returning surplus funds to opted-in bodies;

- ensuring PSAA’s internal auditors review the internal control environment annually to provide assurance on the financial controls and confirm these are working as intended;

- meeting PSAA’s statutory obligations; and

- meeting PSAA’s duties as a good employer.

The internal auditors, TIAA Limited, perform an annual work programme which covers key systems and aspects of the control framework. The results of this work programme are included in the governance report on page 36.

Turnover and profit on ordinary activities

The revenue received by PSAA must cover the costs of paying auditors for work under the audit contracts and the operating expenses of PSAA.

PSAA’s accounts show a £nil profit for the 12 months to 31 March 2023 as revenue is matched to expenditure and any monies not required to cover costs are returned to opted-in bodies at appropriate intervals.

Revenue, including investment income, for the 12 months to 31 March 2023 was £40.838 million (2021/22 £32.911 million) which covered the costs including corporation tax incurred by PSAA for the period 1 April 2022 to 31 March 2023 of £40.838 million (2021/22 £32.911 million).

Controlling costs

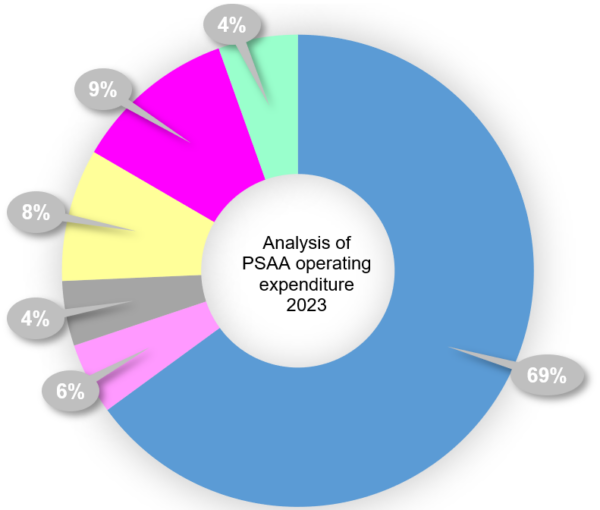

PSAA incurred total costs of £40.838 million, of which the cost of the audit contracts for the period was £39.341 million, 96.3% of total costs (2021/22: £31.401 million which represented 95.5%).

The chart shows the split of PSAA incurred operating expenses of £1.473 million in 2022/23. This represents 3.7% of total costs (2021/22: £1.510 million which represented 4.5% of total costs) and taxation of £0.024 million (2021/22: £0.0002 million).

Financial position

PSAA’s total assets equal total liabilities at the end of 31 March 2023 (31 March 2022: total assets also equalled total liabilities). PSAA is required to pay any surplus funds to opted-in bodies, as provided for in its Articles of Association. Surplus funds are shown as a liability in the balance sheet as part of deferred income. The deferred income is regularly reviewed to ensure PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. Funds no longer required are returned once approved by the Board.

Future developments

During 2023/24 the company will continue to discharge its appointing person responsibilities in relation to the first appointing period and establish a robust contract and financial monitoring framework for the new audit services contracts which commenced on 1 April 2023. PSAA will continue to ensure that both these workstreams are performed to required standards and timescales.

By order of the Board

Steve Freer

Chairman

25 July 2023