Strategic report

The directors present their strategic report for the year ended 31 March 2025.

1. Objectives and operating environment

PSAA’s responsibilities and aims are expressed through our objectives, set out in our Articles of Association, covering the following areas of activity:

- appointing auditors to relevant authorities;

- consulting on and setting a scale or scales of fees, and charging fees, for the audit of accounts of relevant authorities;

- ensuring that public money from audit fees continues to be accounted for properly and is protected;

- overseeing the delivery of consistent, high quality and effective audit services to relevant authorities;

- being financially responsible having regard to the efficiency of operating costs and transparently safeguarding fees charged to opted-in bodies; and

- leading our people as a good employer.

We have a memorandum of understanding (MoU) with key partners including MHCLG and the LGA which sets out the broad framework within which PSAA operates. We expect to agree a new MoU which will cover the period of transition to the LAO.

The Board believes in strong and effective corporate governance. It has in place, and regularly reviews and updates, a comprehensive governance framework to support the company’s functions as an appointing person.

Whilst our core functions as an appointing person remain unchanged, continuing to operate in a complex and evolving environment means that communication and engagement with opted-in bodies and wider stakeholders remains a hugely important part of our work.

2. Business review

This report covers our tenth full year of business. Our focus during the year has been:

- Continuing to embed strengthened contract monitoring arrangements for the audit services contracts for the second appointing period which began in April 2023; and

- Dealing with the consequences of the government’s implementation of backstop dates as part of their proposals for the overhaul of local audit. The two backstop dates during the year have meant that we have had to devise a revised approach for processing a significantly increased volume of fee variations.

Auditor appointments from 2018/19 to 2027/28

Our first set of contracts covered audit appointments for 2018/19 to 2022/23. Contracts continue until every audit under it has been delivered, and so the implementation of backstop dates during the year has significantly impacted the end point. As at 31 March 2025, there were 45 outstanding audits relating to the first appointing period and 42 outstanding for 2023/24.

The firms’ market shares across the two appointment periods are as follows:

| Firm | PSAA market share 2018/19-2022/23 % | PSAA market share 2023/24 – 2027/28* % |

| Grant Thornton UK LLP | 40.00 | 36.00 |

| Ernst and Young LLP | 30.00 | 20.00 |

| Forvis Mazars LLP | 18.00 | 22.50 |

| KPMG LLP | – | 14.00 |

| Bishop Fleming LLP | – | 3.75 |

| Azets Audit Services Ltd | – | 3.25 |

| BDO LLP | 6.00 | – |

| Deloitte LLP | 6.00 | – |

For the first appointing period 98% of eligible bodies opted in. For the second appointing period, 456 eligible bodies (over 99%) chose to opt into the national scheme, with only 4 eligible bodies preferring to make local arrangements for their auditor appointments.

* We awarded contracts for a total of 99.5% of the audit work detailed in our tender. We were able to take into account the impact of scheduled local government reorganisations which resulted in a marginal reduction in the target auditor capacity at the time.

This high level of support from eligible bodies has enabled us to offer a scheme that strives to maximise benefits for participating bodies.

Typically, there are small changes every year in the number of eligible bodies because of reorganisation and/or the establishment of new bodies. Where a new eligible body chooses to opt into the scheme, PSAA is charged with finding an auditor. In 2024/25 we were able to make appointments to all new bodies created in readiness for the 2025/26 audits. This reflects an improved position to the previous year in which we were unable to make appointments to three bodies with atypical characteristics. We have resolved one of these in 2025/26 and the remaining two are to be addressed by the Government’s plans to reform local audit.

A full list of opted-in bodies is published on our website as required by the regulations. Auditor appointments and scale fees 2018/19 – 2022/23 and Auditor appointments and scale fees 2023/24 – 2027/28.

Local Audit Reform

Following the government’s announcement in December 2024 of proposals to overhaul local audit including establishing the LAO, we are working through the implications for PSAA. The LAO will take on the relevant elements of PSAA’s appointing person responsibilities. The indicative timelines mean the transition may occur from as early as Autumn 2026. We have identified the broad areas of work required to support a successful closedown of PSAA and transition to the LAO and will build on this early work in 2025/26 to develop a transition plan that we will implement to ensure a smooth transition, alongside performing our appointing person role.

In the run up to establishing the LAO it is important that work continues on solutions for the more immediate issues impacting local audit. This includes the need to look at the scope of audit work in the current regime, how long the build back of audit assurance will take and the need for a robust inspection regime to provide assurance over audit quality.

Fee variations

Statutory regulations specifically allow firms to submit a fee variation proposal to PSAA where they consider that the work involved in a particular audit was substantially more than provided for by the scale fee. Volumes have increased in recent years, reflecting that local audit no longer operates in its relatively stable pre-2018 conditions, that auditors have needed to increase their work to meet rising regulatory requirements and the restrictions on setting and updating the scale fee itself.

The statutory backstop dates for all years up to 2022/23 and for 2023/24 were introduced at short notice and were only 10 weeks apart. They generated significant volumes of fee variations, including for audit work to issue disclaimers of audit opinions. These variations were processed in the main in the 2025/26 audit year. To meet this additional short-term demand, we temporarily increased our capacity.

Further significant tranches are expected in 2026/27. The Board has therefore commissioned an independent review of our fee variation process to learn from our work to date, to take account of concerns raised and of the views of local bodies and audit firms. The review will allow us to improve our fee variation processes further and ensure arrangements are robust and fit for purpose.

The table below sets out the volume of fee variations processed during the last two financial years along with a projection of volumes for 2025/26.

Number of fee variations

| Fee variation proposals submitted | Financial year April 2023 to March 2024 | Financial year April 2024 to March 2025 | % difference |

| <= £25,000 | 223 | 449 | 101% |

| >£25,000 and <= £50,000 | 129 | 343 | 166% |

| >£50,000 and <= £75,000 | 69 | 113 | 64% |

| >£75,000 and <= £100,000 | 36 | 42 | 17% |

| >£100,000 and <= £200,000 | 62 | 61 | -2% |

| >£200,000 | 24 | 13 | -46% |

| Total | 543 | 1,021 | 88% |

| Number of fee variations submitted | 3,628 | 13,430 | 270% |

Contract monitoring arrangements

We are very aware that quality of audit service delivery is a high priority for opted-in bodies. We work within the boundaries of our remit and the limitations of the local audit market, and endeavour to secure appropriate quality audit services through our contracts with firms.

We have based our model for monitoring the performance of auditors and the quality of the audit services they provide on the International Auditing and Assurance Standards Board (IAASB) Framework. This is set out on our website at Contract monitoring.

Our contract monitoring arrangements reflect our statutory responsibility to monitor firms’ performance against the audit services contracts. It also enables us to report the results of the auditors’ work to audited bodies and other stakeholders.

We oversee any issues relating to our auditors’ independence. This includes reviewing proposals to provide non-audit consultancy services and monitoring the rotation of senior audit staff to minimise the threat of familiarity arising from long association.

The contracts with audit firms from 2023/24 provided the opportunity to significantly evolve our monitoring and reporting arrangements to align with the service delivery and the strengthened compliance requirements in the contracts. We have restructured our staffing and created additional capacity in response.

We have regular dialogue with our contracted firms and formal quarterly meetings covering any issues, performance and contract compliance, and discussion on actions needed.

We publish Quarterly quality monitoring reports on our website to help bodies understand how we are monitoring the performance of audit firms on their behalf, along with other information such as the results of our client surveys.

The results of our monitoring are published annually in our summary Audit Quality Monitoring Review, incorporating the results of the latest professional regulatory reviews undertaken by the FRC and the Institute of Chartered Accountants in England and Wales (ICAEW). In March 2025 we published our report on audits up to 2022/23 following the passing of the backstop date for these audits and noting the limited number of FRC reports. It is the final report under the first appointing period contracts.

We have recently published our annual contract quality monitoring report on the 2023/24 audits. To reflect our strengthened contract management arrangements for the audits from 2023/24, we evolved our approach to the report and the client survey. The survey now provides more timely feedback, and we introduced more firm specific questions.

The survey reported positive feedback against previous years on an improved audit experience; the completion of audits by the target date; communications overall; audits delivered by new auditors including new entrants; timely reporting of significant weaknesses; and the auditor’s performance at Audit Committee meetings.

Where concerns were raised these related to the need for improved communications on fee variations, fees and infrastructure assets; the shortage of experienced auditor resources; the levels of additional review and scrutiny that firms build into their processes on valuations and pensions; and a requirement for better planning and guidance from audit teams.

Other projects

The Public Procurement Act 2023 came into effect in February 2025. The Act improves public procurement in the UK with the aim of making public sector procurement simpler, more flexible, and more transparent. PSAA’s procurement processes have been revised to reflect the changes and future procurements will comply with the requirements of the new Act. We will continue working under the Public Contracts Regulations 2015 until our current contracts, dynamic purchasing system and government and related frameworks that we use expire.

We undertook a significant project to look at all aspects of how and where we work with a wide remit across all areas of staffing. All key recommendations from the review have now been implemented.

We implemented a new e-learning system to support the development of staff. We also implemented a Board and Committee papers management system to improve security and provide more functionality for directors.

Transitional arrangements

Since 1 April 2015 specific functions have been delegated to PSAA on a transitional basis to enable us to deal with the outstanding elements of this work. These transitional powers were extended for a further five years to 31 December 2028. At 31 March 2025 audit closure certificates have not been issued at 6 principal authorities because of ongoing audit work on financial statements, outstanding electors’ objections, or where other investigative work has to be concluded. There is also one smaller authority where the certificate and opinion has yet to be concluded.

3. Risk Management

Risk management arrangements

PSAA has a comprehensive risk management framework that provides assurance to the Board that strategic and operational risks are appropriately managed. Risk management is embedded into the company’s culture and daily operations and is used to support informed decision-making and effective resource planning.

Risk Governance and Responsibilities

The Board oversees risk and opportunity management, ensures governance and internal controls are effective, and approves the risk strategy and appetite. Given PSAA’s role in managing public funds, it maintains a low risk tolerance.

The Chief Executive has overall responsibility for maintaining internal controls and provides assurance to the Board and Audit Committee. Whilst the Chief Executive has overall responsibility for PSAA’s risk management arrangements, the Chief Operating Officer/Deputy Chief Executive provides operational oversight of risk management and acts as the Senior Information Risk Officer.

The PSAA team regularly reviews the corporate risk register, with individual managers responsible for specific risks.

Audit Committee

The Board delegates responsibility to the Audit Committee to oversee risk management. The Audit Committee scrutinises the corporate risk register, reviews and challenges risk assessments and internal control at each meeting and reports to the Board.

Current risks and issues

During the year we have monitored the risks to achievement of our objectives and where appropriate sought to establish mitigating actions.

Many of the risks in our register arise from matters which are largely beyond our direct control, so we have worked to ensure system stakeholders understand the fragile position of local audit.

Overall, our risk profile has lowered as the consequence of the implementation of backstop dates and the government’s plans to reform local audit, although a few new risks have emerged. The significant risks currently facing PSAA are:

- The impact of the backlog solution on our operational activity and capacity for processing an increased volume of fee variations; and

- The period of uncertainty and additional work flowing from the government’s proposals for local audit reform and the creation of the LAO.

Future risks

Over the next year we will face significant challenges as the government progress their plans for local audit reform which create change within the local audit system. These include:

- Significant peaks of audit fee variation proposals including those for work to build back audit assurance following a disclaimed opinion;

- Being an active influencer to ensure that the reformed local audit system as a whole works effectively and meets the needs of audited bodies and users of accounts;

- Managing the uncertainty and insufficient capacity of the local audit market; whilst considering how to increase its sustainability and competitiveness; and

- Understanding the impact of the re-introduction of public provision on local audit and its impact on an already fragile market.

4. Financial review

Being financially responsible

PSAA is committed to securing value for money, ensuring it delivers its objectives while minimising costs. PSAA is a not-for-profit organisation and strives to be financially responsible by:

- exercising financial discipline and maintaining a robust control environment;

- keeping running costs to a minimum;

- returning surplus funds to opted-in bodies;

- ensuring PSAA’s internal auditors review the internal control environment annually to provide assurance on the financial controls and confirm these are working as intended;

- meeting PSAA’s statutory obligations; and

- meeting PSAA’s duties as a good employer.

The internal auditors, TIAA Limited (for 2024/25), perform an annual work programme which covers key systems and aspects of the control framework. The results of this work programme are included in the governance report on page 27. Following a procurement we appointed KOSI Corporation Ltd as our internal auditors from 2025/26 for three years.

Turnover and profit on ordinary activities

The revenue received by PSAA must cover the costs of paying auditors for work under the audit contracts and the operating expenses of PSAA.

PSAA’s accounts show a £nil profit for the 12 months to 31 March 2025 as revenue is matched to expenditure and retained. Any monies that we are satisfied are not required to cover our costs are held in reserve until the Board is satisfied they are not needed, and they are then returned to bodies.

For the 12 months ending 31 March 2025, our revenue was £126.160 million (2023/24: £52.079 million).

The significant increase in turnover reflects the fee rates established through procurement processes under the new contracts introduced in 2023/24, which resulted in a 151% uplift in audit fee rates.

A surplus of £4.946 million was transferred to deferred income aligning revenue with costs of £123.823 million. This practice allows us to absorb any surplus or deficit in a given year.

Controlling costs

PSAA incurred total costs of £126.595 million, of which the cost of the audit contracts for the period was £123.823 million, 97.8% of total costs (2023/24: £50.630 million which represented 96.6%).

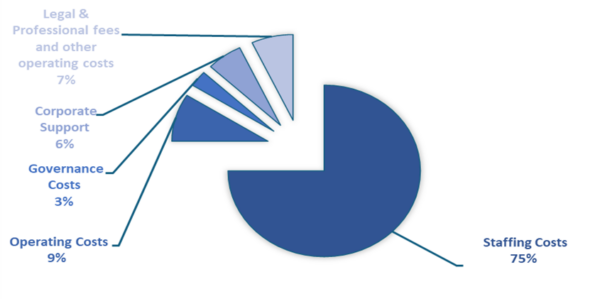

The chart shows the split of PSAA incurred operating expenses of £2.772 million in 2024/25. This represents 2.2% of total costs (2023/24: £1.771 million which represented 3.4% of total costs) and £nil taxation (2023/24: £nil).

Chart 1: 2024/25 operating costs of £2.772 million

The increase in operating expenses reflects higher staff costs. This is driven by a substantial rise in both the volume and complexity of fee variations, the strengthening of contract management processes, and preparations for the PSAA closedown and transition to the Local Audit Office (LAO).

Financial position

PSAA’s total assets equal total liabilities at the end of 31 March 2025 (31 March 2024: total assets also equalled total liabilities). PSAA is required to pay any surplus funds to opted-in bodies, as provided for in its Articles of Association. Surplus funds are shown as a liability in the balance sheet as part of deferred income. The deferred income is regularly reviewed to ensure PSAA has sufficient funds to pay for its operating expenses and manage its cash flow. Subject to Board approval, funds no longer required are returned to relevant bodies.

Future developments

During 2025/26 PSAA will continue to discharge its appointing person responsibilities and administer a robust contract and financial monitoring framework for the audit services contracts. PSAA will also work on a transition plan to prepare PSAA to fold into the LAO.

Bill Butler

Chair

26 November 2025