Financial information

- PSAA is committed to securing value for money to ensure we deliver our statutory objectives while minimising costs. We achieve this by constantly reviewing and assessing the necessity of all expenditure and our level of resources.

- Our latest forecast for the end of 2022/23 shows a surplus of £1.9 million for the financial year. The cumulative surplus at the end of 2022/23 is £7.5 million, made up of £1.7 million generated from transitional arrangements and a projected £5.8 million from Appointing Person arrangements.

- Our 2023/24 budgeted income and firm remuneration are as follows:

- £56.4 million income from audit fees; and

- £50.7 million remuneration paid to firms.

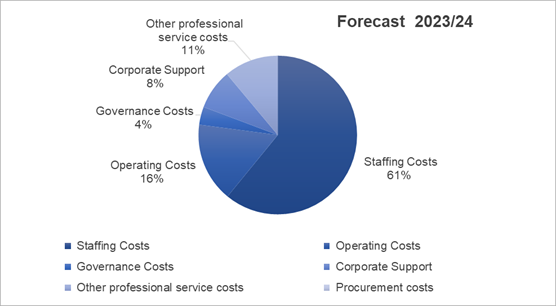

- A significant portion of the 2023/24 forecast running costs is for staff as illustrated in Chart 1.

Chart 1: Forecast for 2023/24 of indirect running costs of £2.0m

- Our five-year Medium Term Financial Plan (MTFP) and cash flow projection reflects a healthy financial position. We operate on a not-for-profit basis. From time to time the Board approves the distribution of surplus funds to audited bodies after ensuring we have sufficient funds to pay for operating expenses and manage cash flow.

- The transitional arrangements (2015-2018) and each appointing period are accounted for separately. This enables us to return surplus funds to the opted-in bodies for the relevant appointing period.

- The Board reviews the company’s financial position at every Board meeting. We approve our annual accounts following detailed scrutiny by and a recommendation to do so from the audit committee.

- Our treasury management policy is risk averse and notes that ‘security over funds is of paramount importance’. The policy is reviewed annually by the Audit Committee which makes recommendations to the Board as appropriate. We actively monitor the performance against the policy and the liquidity of its investment.